Ichimoku is an investment strategy of trend following, it works great on H4, D1 and higher time frames. In this series of articles I present my setups and observations using Ichimoku, supports and resistances and Price Action patterns. You can also check previous Ichimoku overview.

Ichimoku is an investment strategy of trend following, it works great on H4, D1 and higher time frames. In this series of articles I present my setups and observations using Ichimoku, supports and resistances and Price Action patterns. You can also check previous Ichimoku overview.

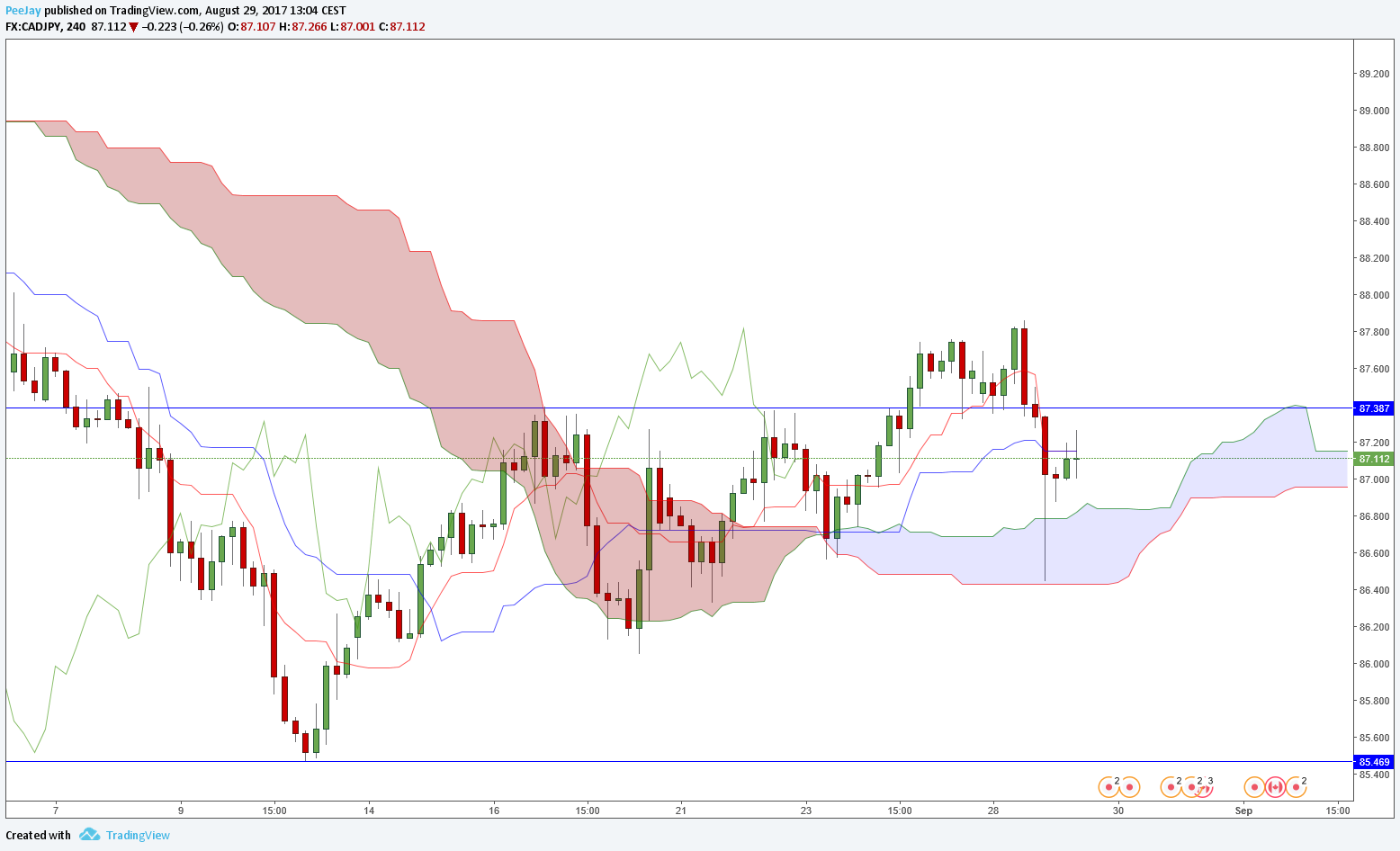

CADJPY

Strong bearish impulse from yesterday caused my position on CADJPY to close on Stop Loss. That’s a shame, it was already on profit and it seems like it should not come back below support. Until further development I don’t plan to open another position.

GBPAUD

Yesterday everything was fine with the position on GBPAUD but when I woke up today morning, it was already closed on SL. Strong gain of the pair in the middle of the night caused the loss. Currently price is inside Kumo cloud, if it will break below we can think about opening short position. However, I recommend to wait for break below support in 1.6170 area.

GBPCHF

Price is in the area of important support from daily chart at 1.2240. If it will be broken permanently, we can open short position with a Stop Loss above broken level. Cloud is bearish and Tenkan is below Kijun. If I will decide to open this position, I will use FXTM platform, which has in its offer over 250 different symbols.

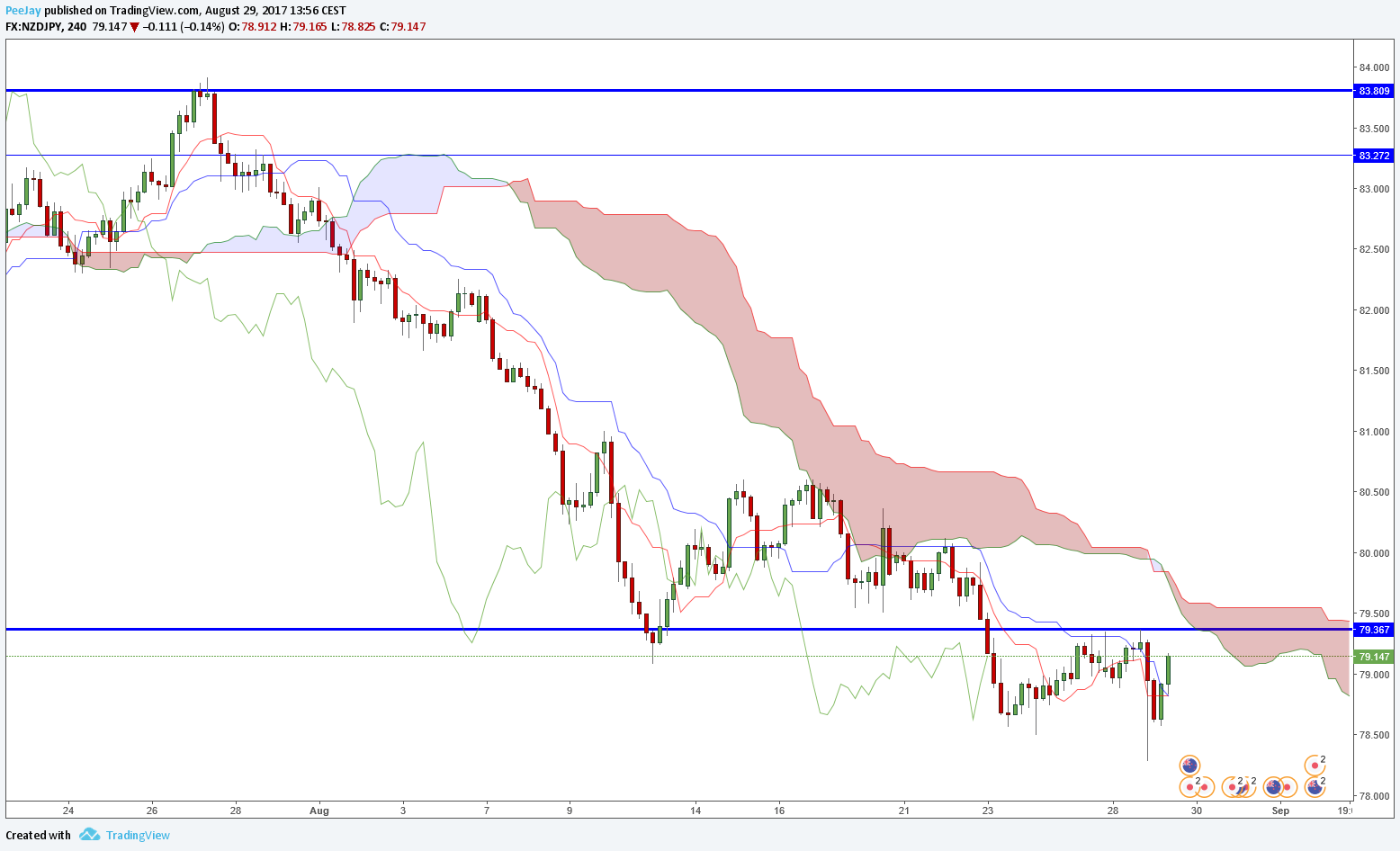

NZDJPY

There is still no clear situation on NZDJPY. Tenkan and Kijun lines are in the same place, and price is getting closer to broken support from daily chart, which should now act as a resistance. Cloud is still bearish, so we can expect continuation of pair weakening.