From Investor to Scalper is a cycle of analysis in which we take one financial instrument and the analysis includes a detailed look at the value from the monthly/weekly chart to the H1/M30.

As a result of declines going on since the beginning of 2016, the GBPCAD currency pair reached the level of 1.5800, where at the beginning of 2017 a demand reaction appeared. Although the later increases were very dynamic, they did not last too long because already in the vicinity of the local resistance was a strong supply reaction. Since then, the market consolidates between these two levels.

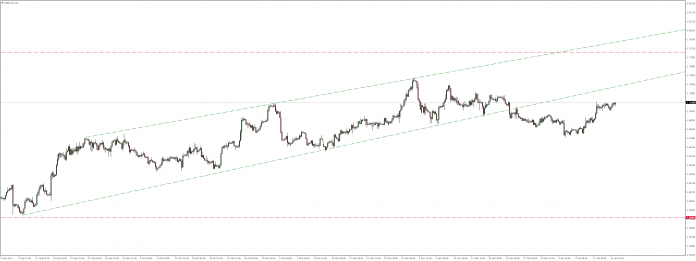

Looking at the weekly chart, we notice that the upper limit of this consolidation coincides with the 38.2% Fibonacci correction from the entire previous decline.

If, therefore, the increases lasting from September 2017 would be continued, we would expect even re-test of the upper limit of this consolidation.

However, it should be noted that as a result of recent declines, the price has already crossed the upward trend line. In the near future we could expect its re-test, however, if this resistance is rejected, we could witness return to declines.

Error, group does not exist! Check your syntax! (ID: 4)

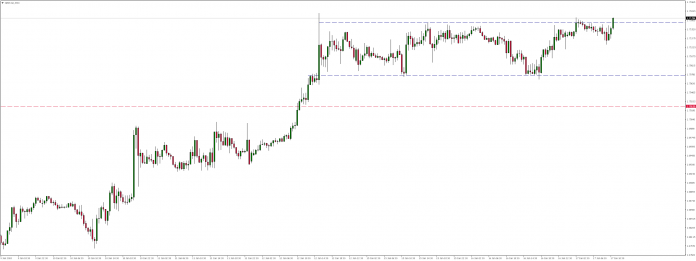

The current situation on the 30-minute interval, where the price breaks the top of the local consolidation, may support growth.

Its worth mentioning that today at 4:00 PM we will know the decision of the Bank of Canada regarding interest rates. The consensus before this publication assumes that BoC will raise interest rates to 1.25% from 1.00% at present.

BoC clearly balances between the need for decisions about the current shape of its policy and the preparation for possible changes in the future. In connection with the risk of the NAFTA agreement, today’s decision of the Bank will not be easy, said Scotiab analysts in today’s currency review.

According to Deutsche Bank analysts, the tone of the increase itself will prevail over market reaction. We all hope that the BoC will match the Fed in the number of rate hikes this year (…) there is no doubt that the Canadian labor market and a strong trend in price levels will allow it – we read in a comment of Deutsche Bank published yesterday evening.