Warsaw, 19.08.2021 (ISBnews/ Superfund TFI) –

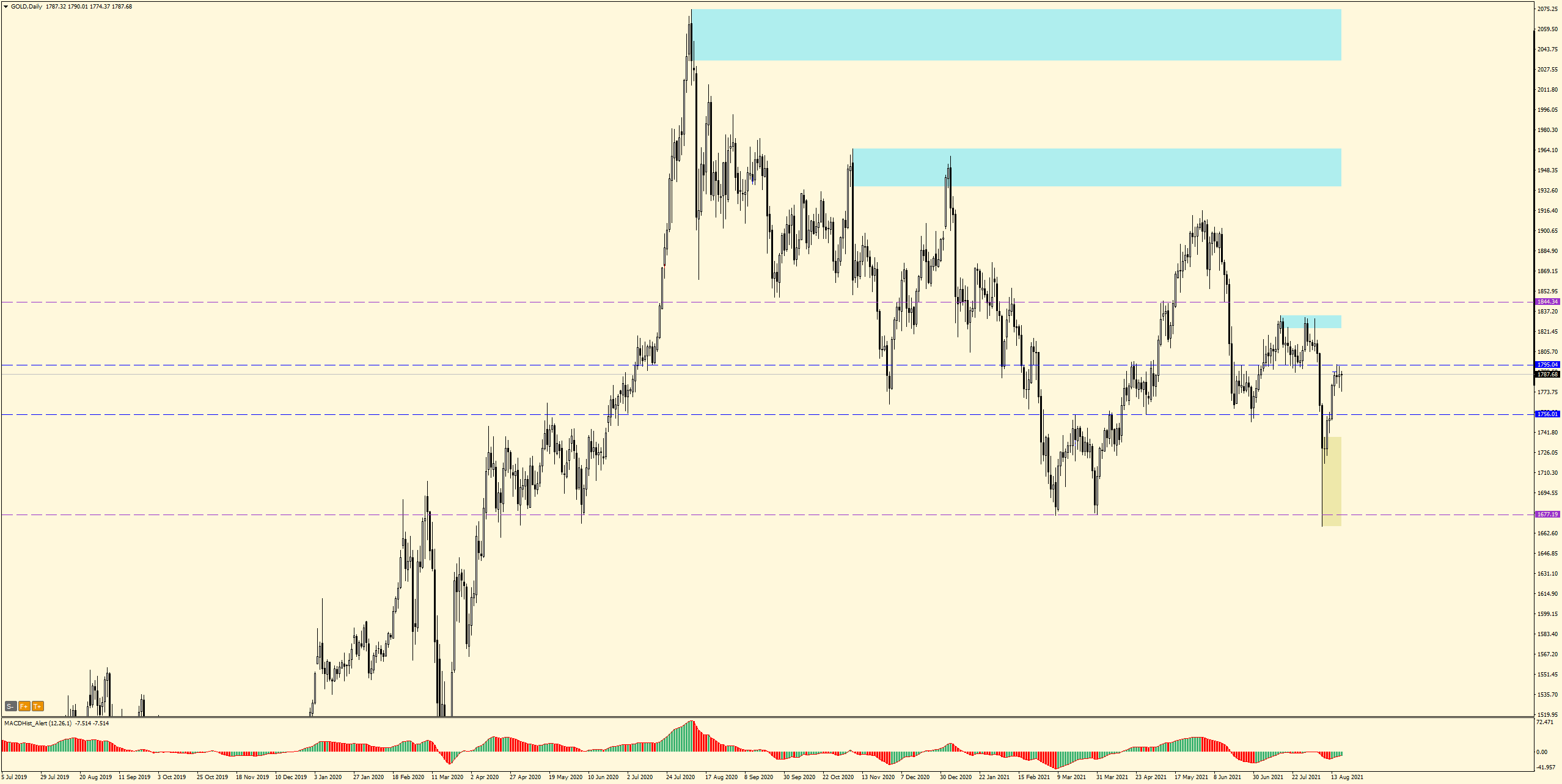

Recent weeks on the gold market have been extremely exciting. After two sessions of dynamic declines in gold prices on 6 and 9 August, gold prices stabilized and began to recover, erasing almost all of the losses from the two days of decline. In the second half of this week, however, the increases slowed down, and important price drivers began to appear on the horizon again in the form of information on the planned actions of the US Federal Reserve.

This week, gold contracts approached the level of USD 1,800 per ounce, but failed to breach this psychological resistance level.

On the financial markets, there was information that favoured sellers on the gold market. These were the minutes of the FOMC meeting (the Federal Reserve’s Open Market Committee), which presented more information on potential Fed actions in the coming months.

The FOMC minutes first and foremost confirmed that Federal Reserve representatives are seriously thinking about starting the process of withdrawing from the massive asset purchase programme. At the same time, not all members of the FOMC are enthusiastic about this topic, and the decision on tapering should also take into account macroeconomic data from the US. In particular, this concerns data from the labour market, which according to the Fed are an important indicator of the condition of the American economy.

The above-mentioned information favoured the growth of the US dollar, and at the same time had a negative impact on gold quotations. However, this does not mean anything, because in front of us there is a key event, which is the symposium in Jackson Hole, scheduled for 26-28 August this year. Many investors expect that during this symposium, Fed Chairman Jerome Powell will provide even more concrete information on the timing of the potential start of tapering in the US and even hints on future interest rate hikes.

Paweł Grubiak – CEO, investment advisor at Superfund TFI