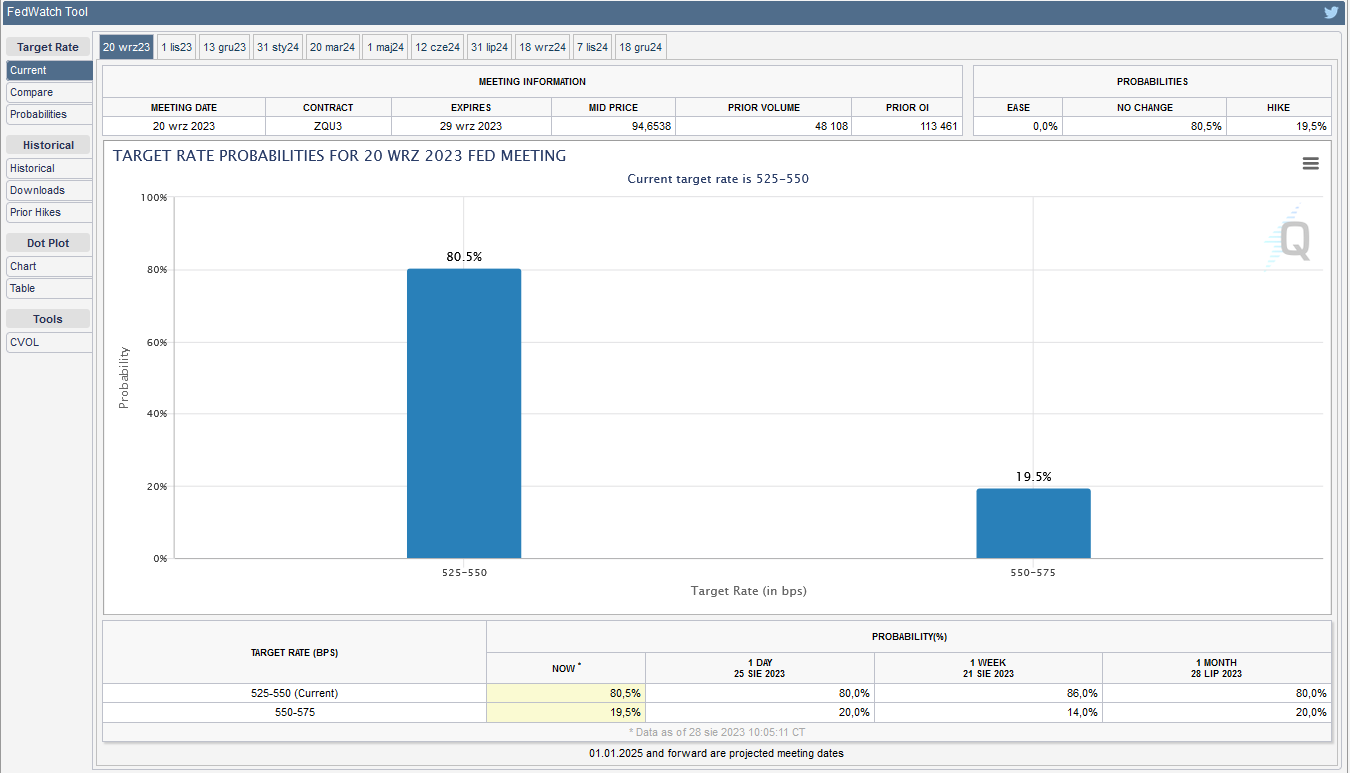

At a symposium in Jackson Hole, last Friday at 4:00 PM ET, Federal Reserve Chairman Jerome Powell during a speech reaffirmed the Fed’s aim to reach its 2% inflation target. He stressed that further interest rate hikes would be warranted if economic conditions demanded it.

Powell also stated that a reduction in economic growth below the typical trend will likely be necessary to steer inflation back to the planned 2%. Powell also stressed that Fed decisions will remain dependent on incoming data (data dependent). Currently, some analysts believe that the Fed may decide to keep interest rates unchanged at its next meeting, but if there is no indication of an economic slowdown and inflation remains high going forward, an additional interest rate hike could be considered by the end of this year.

Worth noting this week

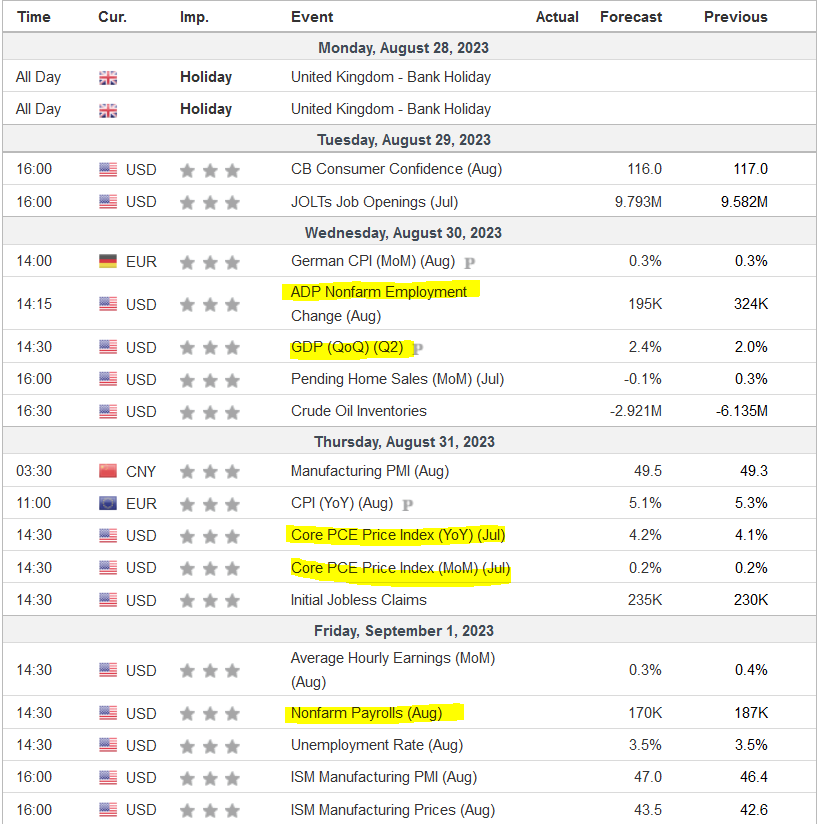

The coming week will be full of several noteworthy events:

Tuesday, August 29

Attention will focus on the release of CB Consumer Confidence data and JOLTS Job Openings data in the US. US CB Consumer Confidence is likely to fall slightly from 117.0 to 116.2, while JOLTS Job Openings are likely to rise from 9.58 million to 9.70 million.

Wednesday, August 30

Wednesday will bring key inflation data for Australia, as well as inflation data for the Eurozone. In the United States, the main event will be ADP non-farm employment change, preliminary GDP q/q and preliminary GDP price index q/q. In the United States, ADP non-farm employment expectations are for a decline from 324,000 to 201,000. As for economic growth, GDP is likely to exceed expectations at around 3%, but this trend is not expected to continue in the near future.

Thursday, August 31

The United States will again be in the spotlight on Thursday with the release of core PCE data, personal income m/m, personal spending m/m and unemployment claims. As for the core PCE index, it is expected to rise by 0.2% on a monthly basis. Similarly, the core PCE index is expected to rise by 0.2%. Taken together, these data may signal a continuing disinflationary trend.

Friday, September 1

At the end of the week, Switzerland will share its CPI data, while Canada will publish GDP and manufacturing PMI data. In the United States, attention will focus on average hourly earnings m/m, the change in non-farm employment a.k.a. the notorious payrolls, the unemployment rate, the final PMI for manufacturing, the ISM PMI for manufacturing, ISM prices for manufacturing and construction spending m/m.

In the United States, analysts expect non-farm employment to fall from 187,000 to 169,000. The unemployment rate is expected to hold steady at 3.5%. As for average hourly earnings on a monthly basis, a 0.3% increase is forecast, compared to 0.4% the previous month, suggesting a slight slowdown in earnings growth.

The ISM Manufacturing PMI in the U.S. is expected to rise slightly, from 46.4 to 46.9. The manufacturing sector has faced challenges from increased interest rates, which have affected it more strongly than other sectors of the economy.

Among the most important events in the above list I would include (highlighted in yellow). The Fed, in deciding on interest rates on September 20, will be guided by the situation in the labor market and the level of inflation.

We can talk about this week’s events and their possible impact on the quotations of currencies and other financial instruments during the live session:

LIVE EDUCATION SESSIONS

This WEEK (28-31 August 2023 ) I am pleased to invite you to several online sessions. Below is the schedule of meetings:

Links: BASIC (beginners room) ADVANCED ROOM

Links: BASIC (beginners room) ADVANCED ROOM

The above analysis is based on the PA+MACD strategy, a detailed description of which you can read HERE . I will talk more about the PA+MACD strategy applied to these currency pairs during the live trading sessions which you can attend from Monday to Friday.

More current analysis on the group : Trade with Dargo