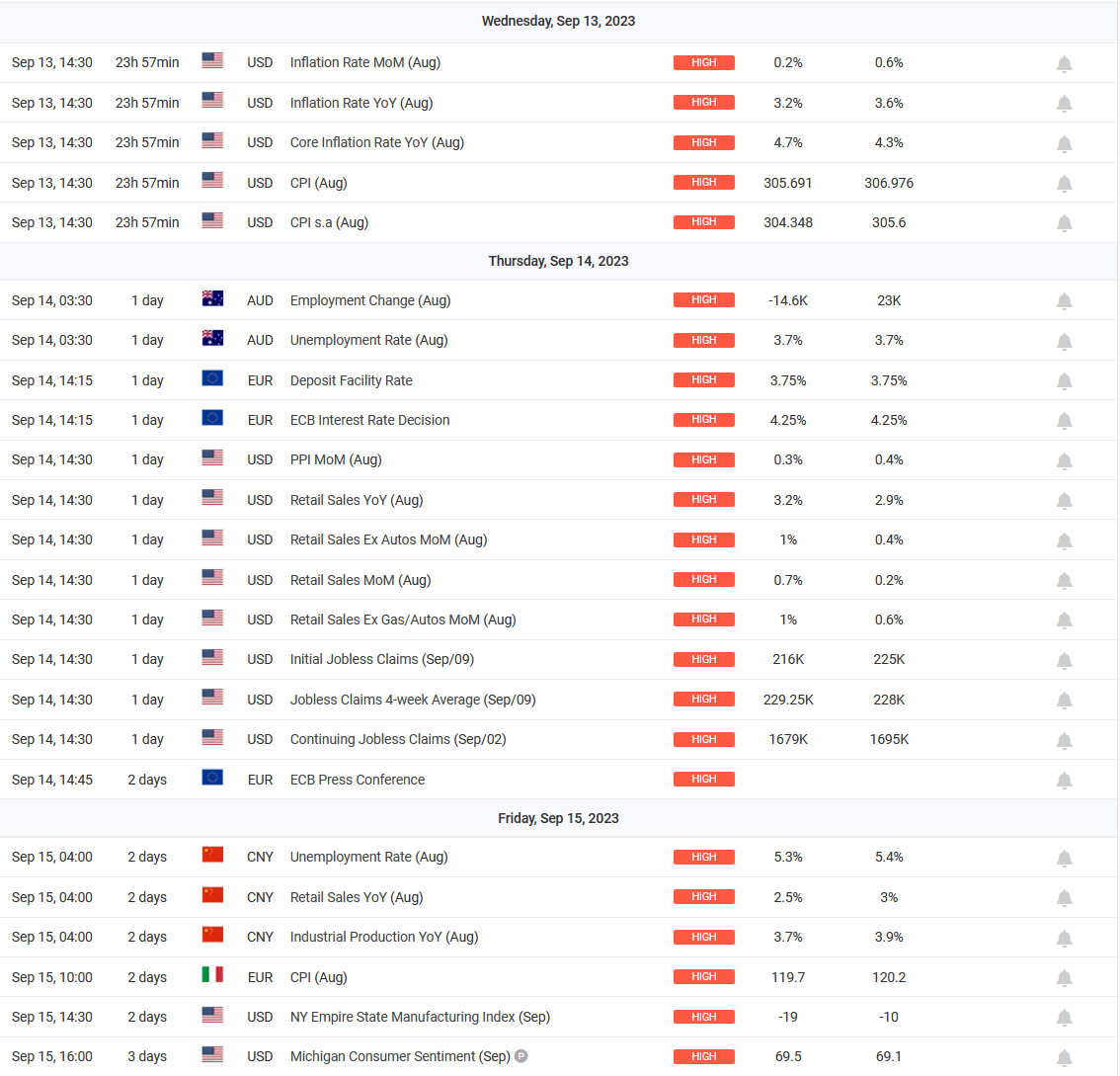

This week the market is waiting for two important events. The first ( Wednesday 2:30 pm) is the level of inflation in the US, and the second is Thursday’s ECB decision on interest rates in the Eurozone. Both events will undoubtedly affect currency rates and some commodities.

Wednesday , September 13 – inflation in the US

This month, on September 20 to be exact, the Fed will decide on interest rates in the US. The Fed’s main goal is to bring inflation down to 2% with as little damage to the labor market as possible while avoiding a recession. When deciding on the cost of borrowing, the Fed takes into account several factors, but undoubtedly the most important are the labor market, inflation and positive GDP.

Current data from the labor market indicate a fairly stable situation. The latest payrolls were higher than expected at 187,000 new non-farm jobs. A little worrisome was the unemployment rate, which rose from 3.5 to 3.8%.

In the second quarter, U.S. GDP came in at 2.6%, up 0.8% from the previous quarter, which may indicate the absence of a recession and the effectiveness of the Fed’s monetary policy.

US inflation last month was 3.2%. Tomorrow’s reading could have a big impact on the Fed’s decisions , so we can expect a lot of volatility after the release of the data, which will be known at 1:30 pm GMT+1

Thursday, September 14 – European Central Bank decision – now or never?

The ECB faces a difficult decision in the face of high inflation and signs of recession in the German economy. But the bottom line is that if the ECB is not sure it has done enough in terms of interest rate hikes, this week is perhaps the last opportunity to actually make one more hike. Holding off on a hike in September and promising hikes at future meetings could be taken negatively by the market.

With the eurozone economy facing a growing risk of recession and credit conditions tightening, the market will not believe the promise to raise interest rates in the coming months. A statement that they do not intend to rule out further rate hikes depending on macro data will not satisfy the markets, as this narrative has already been in place since the spring.

Currently, the chances of a 25 basis point rate hike are about 41%. If the ECB fails to deliver, this will be a negative factor for the euro and regional bond yields, as investors will have to re-price.

Simply put, if the ECB does not raise interest rates this week, it will be even more difficult for them to do so at their next meeting, and this is a key downside risk for the euro this week.

We can talk about this week’s events and their possible impact on the quotations of currencies and other financial instruments during the live session:

LIVE EDUCATION SESSIONS

This WEEK (11-15 September 2023 ) I am pleased to invite you to several online sessions. Below is the schedule of meetings:

Links: BASIC (beginners room) ADVANCED ROOM

Links: BASIC (beginners room) ADVANCED ROOM

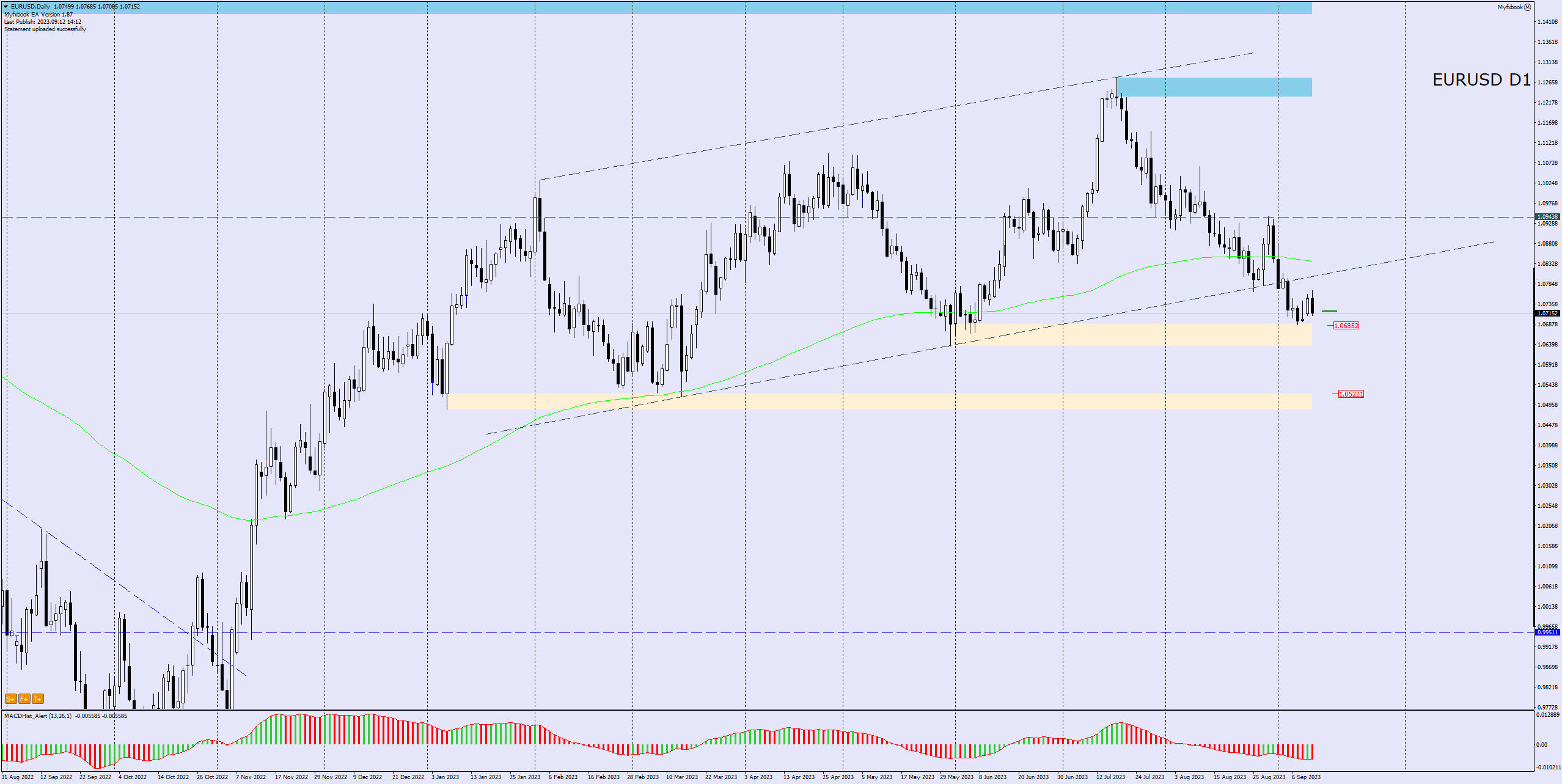

The above analysis is based on the PA+MACD strategy, a detailed description of which you can read HERE . I will talk more about the PA+MACD strategy applied to these currency pairs during the live trading sessions which you can attend from Monday to Friday.

More current analysis on the group : Trade with Dargo