To begin with, a few words explaining where this abbreviation WTI comes from and what it has to do with oil… because, as it turns out, oil does not have a single name.

West Texas Intermediate (WTI), also known as Texas light sweet, is an oil species used as a benchmark for world oil prices. It is referred to as ‘average crude oil’ because of its relatively low density and ‘sweet’ because of its low sulphur content. It is the primary commodity of futures contracts for oil on the New York Mercantile Exchange.

The WTI price is often mentioned in the oil price news, along with the price of Brent oil from the North Sea. Other important oil markers are: Dubai Crude , Oman Crude, Urals and OPEC Reference Basket. WTI is lighter and sweeter, contains less sulphur than Brent, and is much lighter and sweeter than Dubai or Oman.

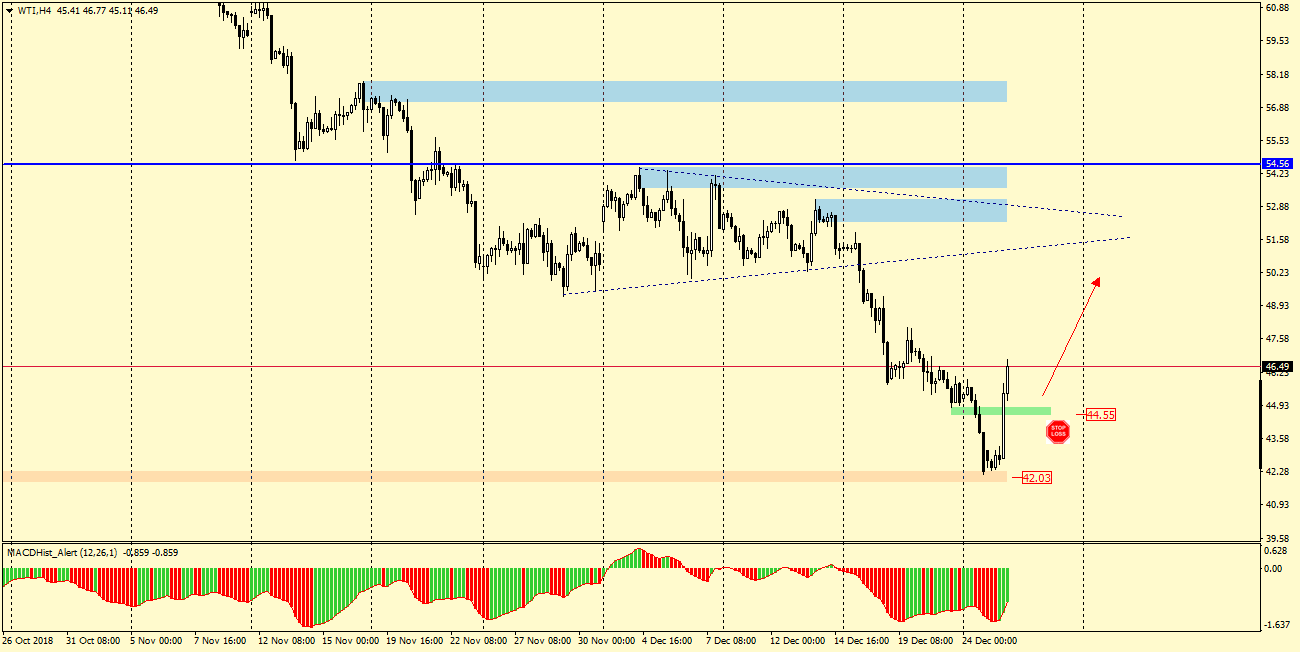

OIL.WTI quotations set a maximum of 77.14 this year at the beginning of October. Since then, drops have begun that lasted almost continuously and in only three months the price of oil has reached 42.00. Is this already the bottom…from which there will only be increases? It is difficult to answer this question, but we can at least analyse what we can expect over the next few sessions.

The daily chart shows that today’s candle is the Outside Bar, the so-called bull market, which usually heralds a change in the trend, or at least a correction. Additionally, an upward divergence on the MACD has started, which supports the signal for growths.

Analyzing the H4 chart below, it seems possible that during the probable correction of the recent falls the price may return to the triangle from which the breakout took place on 17 December.

Assuming the support of this triangle as the closest objective of demand, a level of 50.20 seems achievable. If, however, the price goes back below the local (green) demand zone 44.55, the upside scenario may no longer be valid, which makes it a good level for Stop Loss for buy orders.