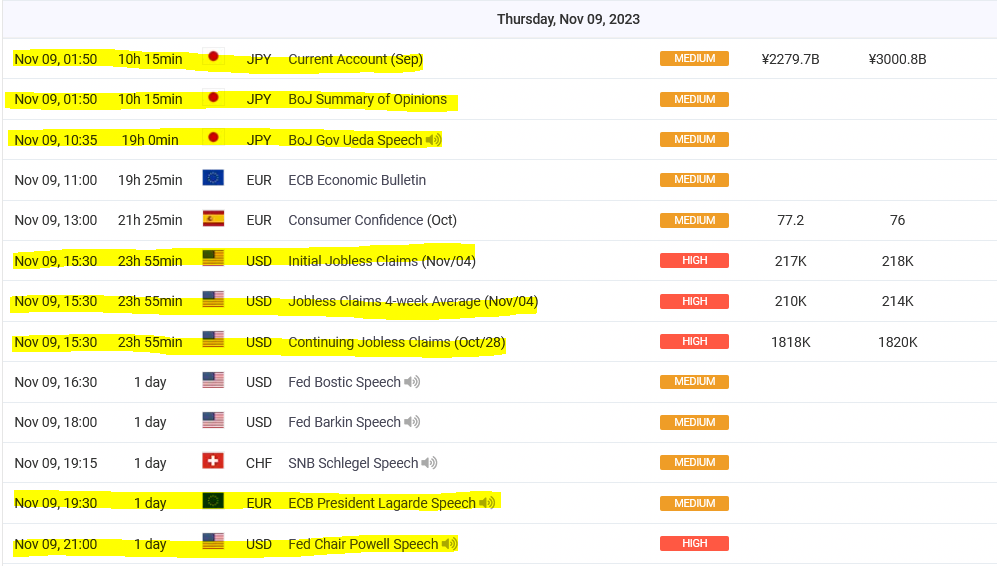

Tomorrow morning in the early hours of the Asian session (0:50 GMT), the economic calendar will include some interesting events important for JPY ( check the picture)

The Current Account balance is calculated as the difference between exports minus imports of products and services, net factor income (such as interest and dividends), and net transfer payments (such as foreign aid).

The Current Account balance is calculated as the difference between exports minus imports of products and services, net factor income (such as interest and dividends), and net transfer payments (such as foreign aid).

A higher than expected figure should be seen as positive (bullish) for the JPY while a lower than expected figure should be seen as negative (bearish) for the JPY.

BoJ summary of opinions

During its Monetary Policy Meetings, the Bank of Japan’s Policy Board determines the interest rates that will be implemented. The discount rate is the official interest rate of the Bank of Japan. MPCs establish a recommendation for money market operations during inter-meeting times, and this sometimes can be an occasion to change something in monetary policy. Few hours later (9:30 GMT) the governor of Bank of Japan will have a speech.

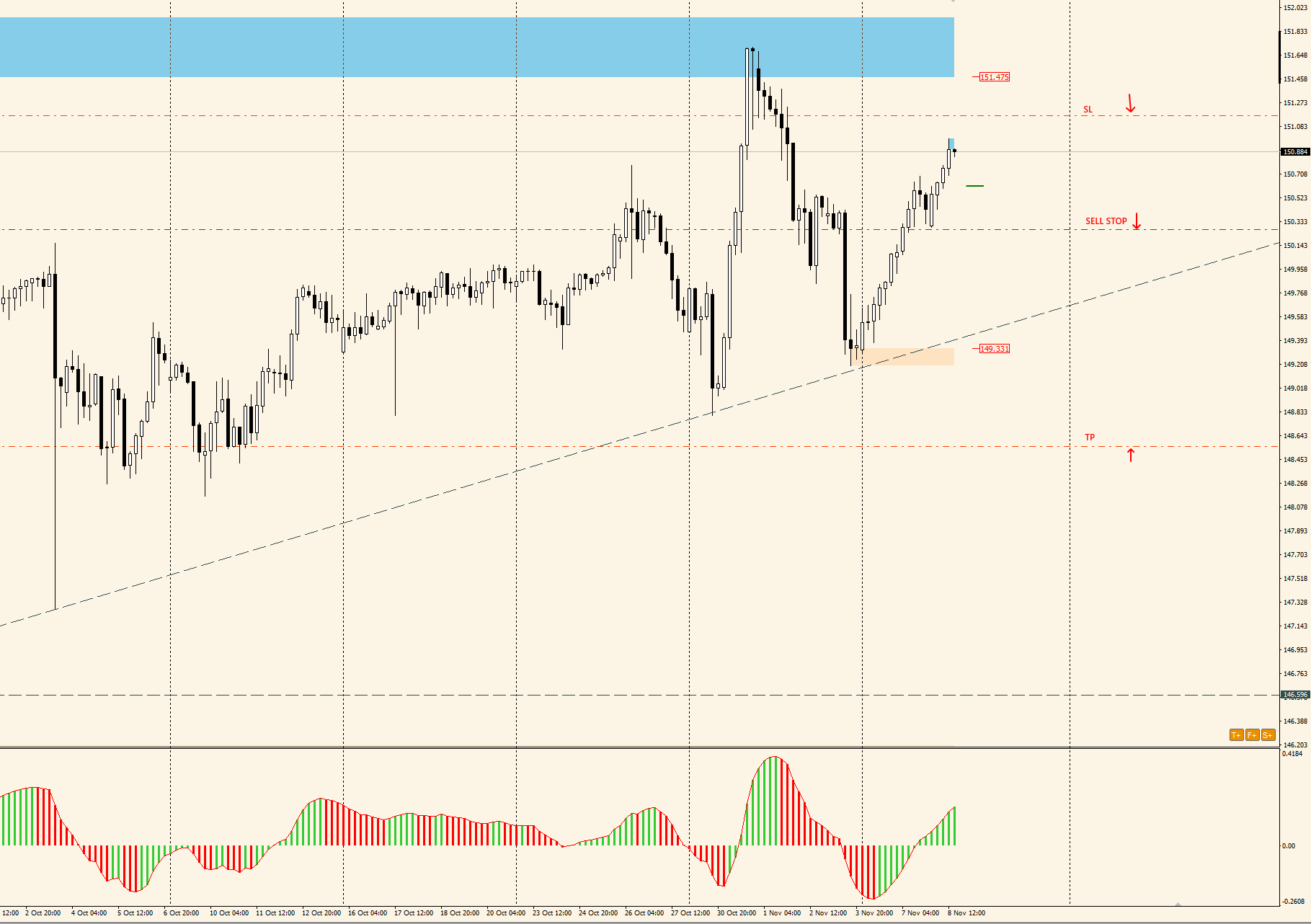

USDJPY – a pending SELL

All these events rise the risk of increased volatility on the JPY. The JPY has been losing to the USD and most global currencies. Only in 2023 it is weaker ca 20% to USD. It may be that the BoJ will want to strengthen its currency tomorrow with verbal or maybe technical intervention. I have therefore decided to place a SELL pending order in case the JPY suddenly strengthens and USDJPY falls.

LIVE EDUCATION SESSIONS

This WEEK (6-10 November 2023 ) I am pleased to invite you to several online sessions. Below is the schedule of meetings:

Links: BASIC (beginners room) ADVANCED ROOM

Links: BASIC (beginners room) ADVANCED ROOM

The above analysis is based on the PA+MACD strategy, a detailed description of which you can read HERE . I will talk more about the PA+MACD strategy applied to these currency pairs during the live trading sessions which you can attend from Monday to Friday.

More current analysis on the group : Trade with Dargo