The 44th week of this year promises to be an exciting one. The economic calendar will be full of important events. Today we take a look at what awaits us on Tuesday and Wednesday.

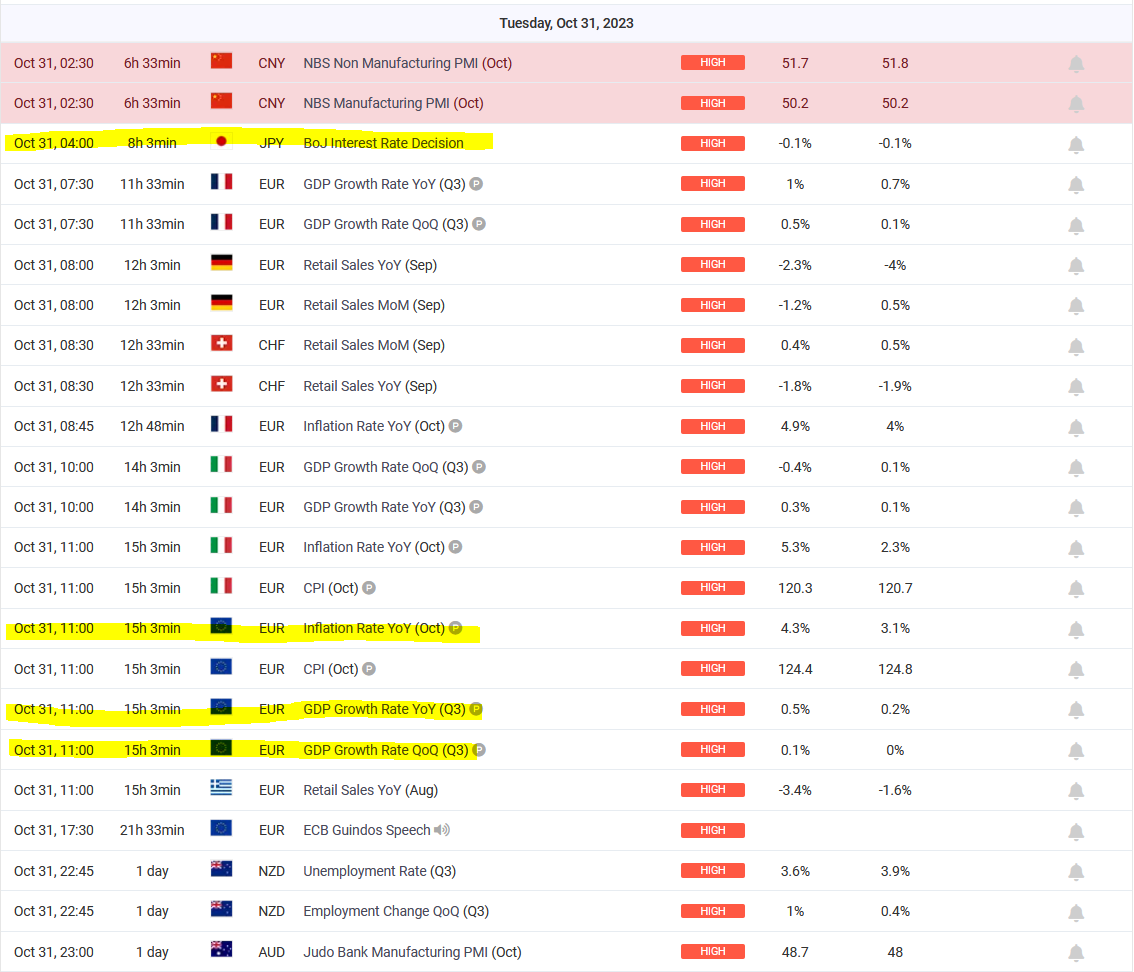

Tuesday will start early for traders, as we will learn the BoJ’s monetary policy decisions at 4am. There were news at 3pm today that the BOJ will change its so-far dovish stance and allow 10-year yields to exceed 1%’, but the text only says they will ‘consider it’. There is no mention of what ceiling, if any, might replace the policy, but investors are speculating about 1.25% or 1.50%. Following this news, USDJPY fell by 100p, the yen strengthened against most currencies. In just a few hours, we will see if the Bank of Japan will take a decision to change its dovish policy in order to save the weakening from 2020 national currency.

The Eurozone inflation report will be released at 11am. The previous reading was 4.3% and the expectation is for a much lower 3.1%. This data is bound to affect the EUR against the USD and the major forex currencies.

Wednesday will be no less interesting. As early as 13:15, we will learn the labour market report prepared by ADP (Automatic Data Processing, Inc). According to the ADP National Employment Report, private non-farm employment in the United States is monitored. It is compiled by Automatic Data Processing, Inc. and is based on actual payroll data from approximately 24 million workers. The expected figure is 150tys of new employees, compared with the previous month’s figure of 89tys.

Higher than expected data should be seen as positive (bullish) for the USD, while lower than expected data should be seen as negative (bearish) for the USD.

At 14:45 and 15:00 we will receive data on the situation in companies (manufacturers). The Manufacturing ISM Report On Business’s survey results indicates any change in the current month compared to the previous month, based on data obtained from purchasing and supply executives countrywide. The report includes the percentage of respondents who responded in a positive or negative economic direction, as well as all five indicators, were evaluated based on the characteristics: New Orders (30%), Production (25%), Workforce (20%), Provider Delivery Times (15%), and Inventory of Items Purchased (10%), and Stock of Items Purchased (10%), with the Delivery Times index reversed so that it moves in the same direction as the other four indexes. A PMI score of greater than 50% implies that the manufacturing economy is increasing in general; a value of less than 50% suggests that the manufacturing economy is contracting in general.

A higher than expected figure should be seen as positive (bullish) for the USD while a lower than expected figure should be seen as negative (bearish) for the USD.Predicted values are 49 and 50.

Higher than expected data should be seen as positive (bullish) for the USD, while lower than expected data should be seen as negative (bearish) for the USD.

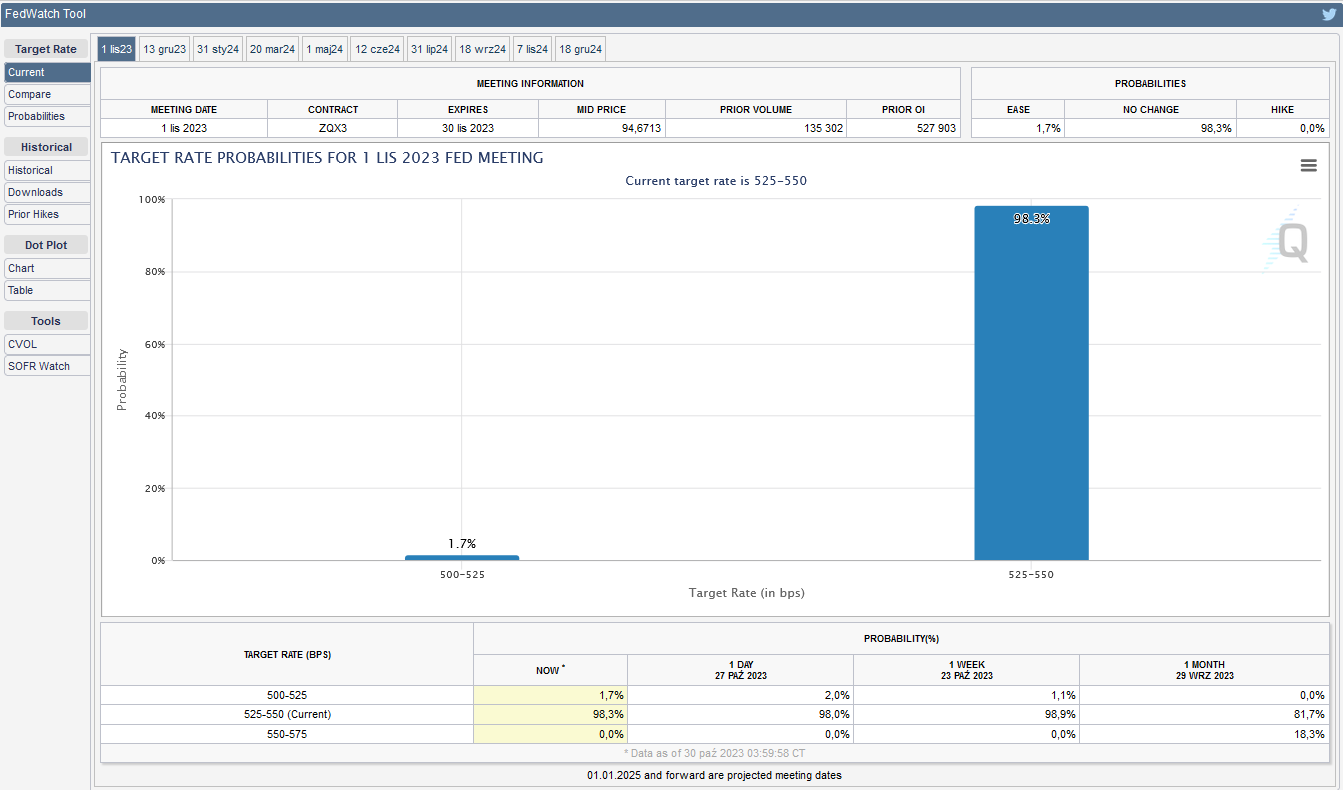

The cherry on the cake, of course, will be the Fed decisions, which will be announced at 7 p.m. No interest rate hike is expected and rates are likely to remain at 5.5%, which the market will take with confidence. At 7.30 p.m. there will be a press conference by Fed Chairman J. Powell, and this is where volatility may increase – as questions will be asked about the Fed’s future plans. The market will be looking for a statement on whether there will be another rate hike this year and what indicators the Fed will use to make its decision in December.

The cherry on the cake, of course, will be the Fed decisions, which will be announced at 7 p.m. No interest rate hike is expected and rates are likely to remain at 5.5%, which the market will take with confidence. At 7.30 p.m. there will be a press conference by Fed Chairman J. Powell, and this is where volatility may increase – as questions will be asked about the Fed’s future plans. The market will be looking for a statement on whether there will be another rate hike this year and what indicators the Fed will use to make its decision in December.

LIVE EDUCATION SESSIONS

This WEEK (30 Oct – 03 November 2023 ) I am pleased to invite you to several online sessions. Below is the schedule of meetings:

Links: BASIC (beginners room) ADVANCED ROOM

Links: BASIC (beginners room) ADVANCED ROOM

The above analysis is based on the PA+MACD strategy, a detailed description of which you can read HERE . I will talk more about the PA+MACD strategy applied to these currency pairs during the live trading sessions which you can attend from Monday to Friday.

More current analysis on the group : Trade with Dargo