On Monday USA has work-free day and I expect continuation of rebounds in Europe and yen weakening, maybe also strengthening of commodity currencies.

On Friday I wrote about sell signal on AUDJPY, but I didn’t wanted to play against AUD and that saved me from Stop Loss. We just have to look for another opportunities:

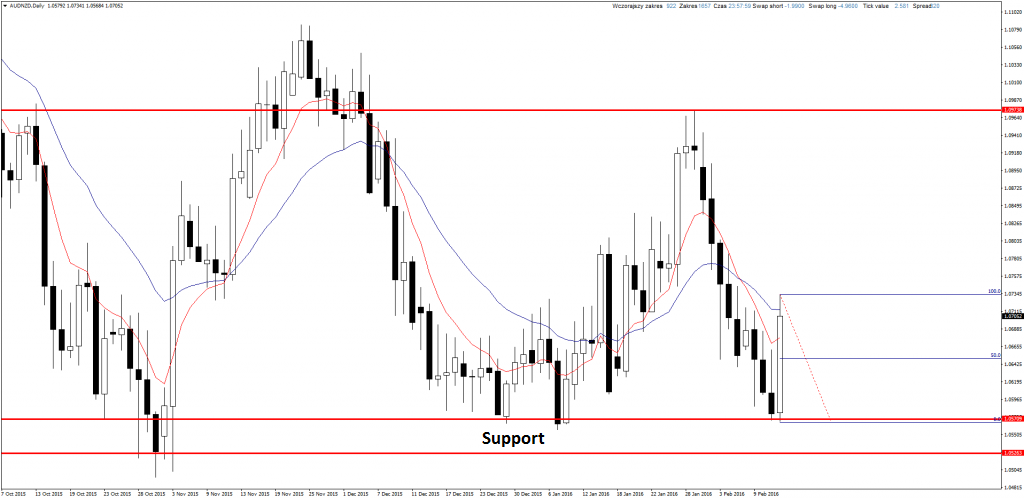

AUDNZD

Buy signal on this pair in shape of Outside Bar. Friday’s candle engulfed Thursday’s one and we have to set buy limit order on 50% retracement. It won’t be really good RR position (a little more than 3:1) but it is really enough, especially because signal is really clear.

GBPCHF

On this pair I still look for some Price Action sell signals after strong break of support. One position ended with SL but on H4 chart we can see another sell signal in form of Pin Bar. The question is what will be the opening and if price will not rise above mentioned candle.

GBPJPY

Here I also look sell signals. Important resistance is tested and if there will be any shorts signals, it will be consistent with long term trend and probably will end bullish correction.

NZDJPY

On Friday pending order opened. Friday’s candle is a clear Pin Bar rejecting support and what’s more there was a false break in last lows area. It all caused that I assumed signal as strong and I have opened long position.

USDCHF

Finally short opened on this pair. Price tested 50% retracement of bearish Pin Bar from Wednesday and also resistance for another time and sell limit order has been activated.