Starting from 09:00, Eurozone countries were giving results of forecast PMI data for May in addition with relevant macroeconomic publications for the German economy. As a result, EURUSD has seen several waves of growth, which allowed to draw a new session highs.

French and German industry at 6-year maxima

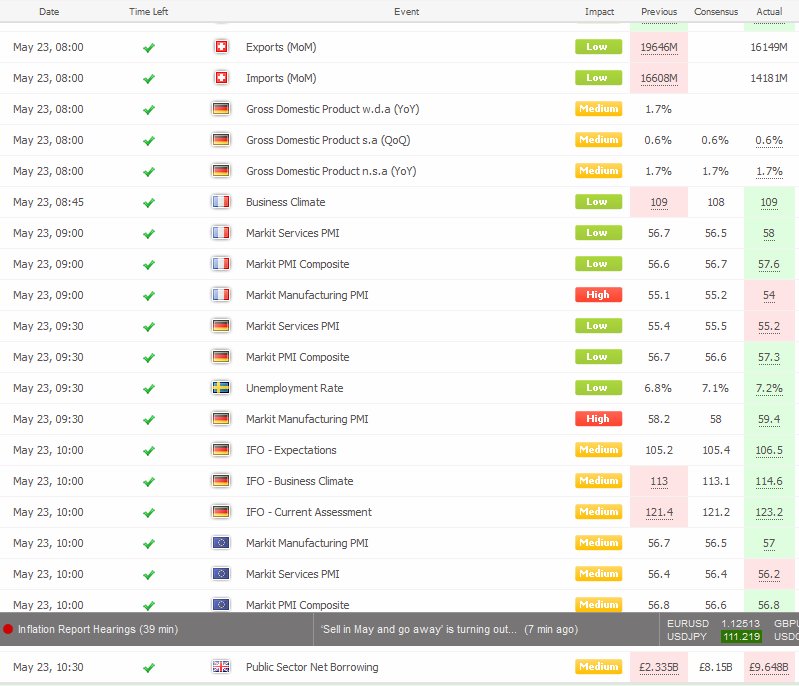

All macroeconomic data published between 09:00 and 10:00am is presented at the following screenshot:

As you can see, preliminary data on industrial PMI in Germany and France maintained positive dynamics, deepening the six-year highs. Some of the indicators fell slightly worse than the projection, but still maintained very good historical results.

Then markets learned the results of economic mood indicators of the IFO for Germany, which rose to 114.60. The euro area industrial PMI rose to 57.00 in the industrial sector, while the service sector recorded a slight drop to 56.20. The cumulative index, however, eventually made another month of dynamic appreciation:

Third time lucky EUR?

Eurodollar tested 38.2% of yesterday’s growth impulse before publication of first macroeconomic data from the euro area. In this place a base was created, which combined with the data brought the first growth impulse. At 9:30 am another test session of Monday’s highs appeared.

Despite generally good data from 10:00, Eurodolar reacted with declines at first but price is still 20 pips higher than before publication:

On D1 chart, we see another day of gains and so far unsuccessful attempts to overcome yesterday’s maxima. Before approaching 1.1300 (November 2016 peak), there is one more stop around 1.1250: