US Stock Market

The pandemic has opened up investing opportunities in the healthcare sector. While buying stock in major companies may be attractive, I feel that investing in healthcare ETF (XLV) may be a better and more conservative option.

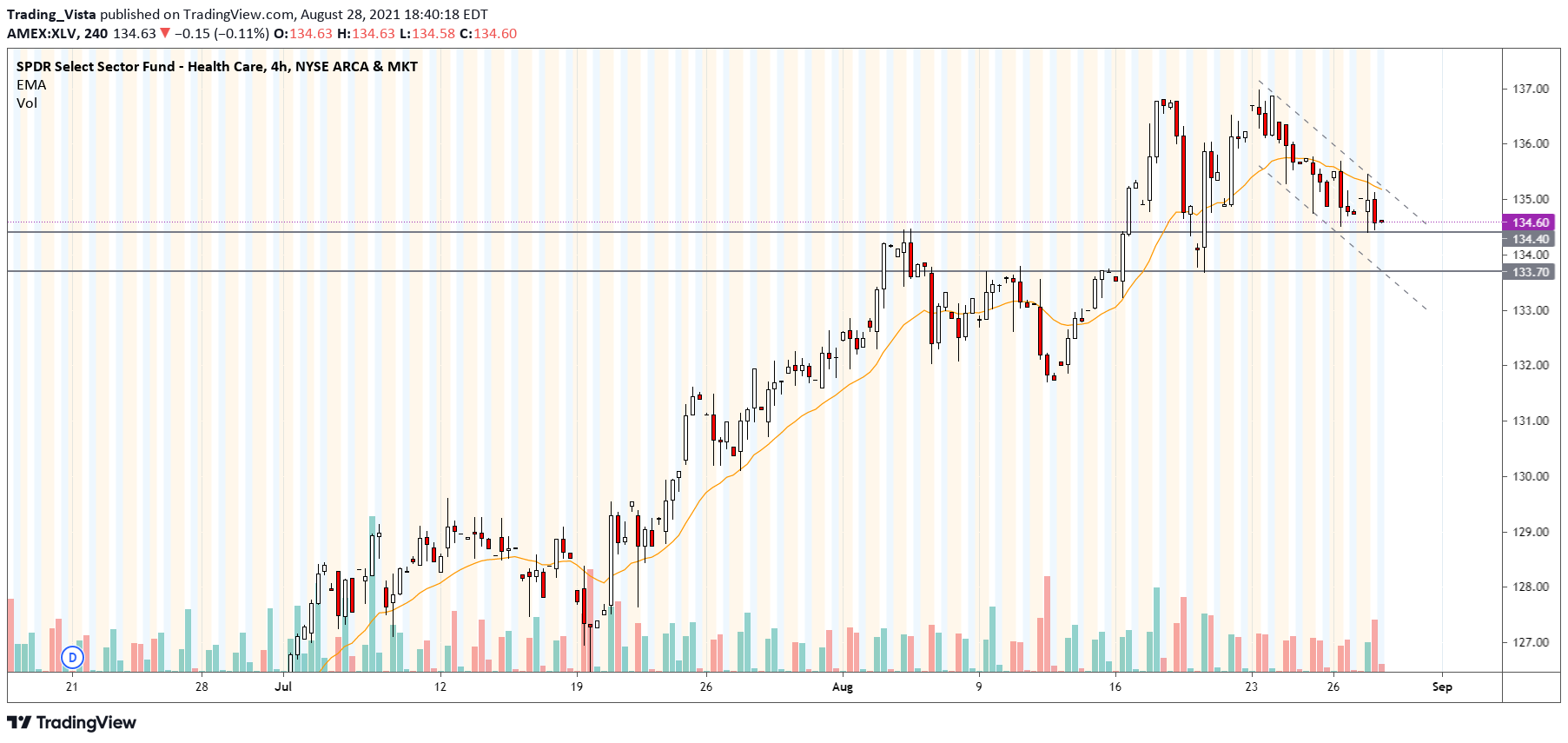

XLV recently hit a 52 week high but as you can see it has been pulling back (perhaps in part due to the uncertainty caused by the delta variant). I see significant support between 133.70-134.40 nearby and will be watching price action closely to enter a long trade.