It may seem unbelievable, but Canadian oil on the internal market currently costs … $5 per barrel. There are several reasons for this, but the most important one seems to be the problem with transport, or basically with delivering it to ports from where it can be sent further into the world. The inadequate capacity of the existing pipelines from which Canadian crude oil can be exported has resulted in the fact that the road and rail transport used significantly increases the cost of the raw material and limits its export. Other problems of the oil companies in Alberta are, in addition to the above mentioned problem of transport outside the province, high production, and the insufficient number of refineries in Canada. For example, there are four refineries in the Alberta province processing less than 0.5 million barrels per day, the rest of the production is exported outside the province.

Rich deposits of oil sands are located in the Canadian province of Alberta. Geologists have estimated that there are approximately 1.8-2 trillion barrels of oil in the Alberta oil sands. This is several times more than on the Arabian Peninsula. The recoverable reserves of Alberta are twice as big as those of Kuwait, Iraq or Iran, and only slightly smaller than those of Saudi Arabia.

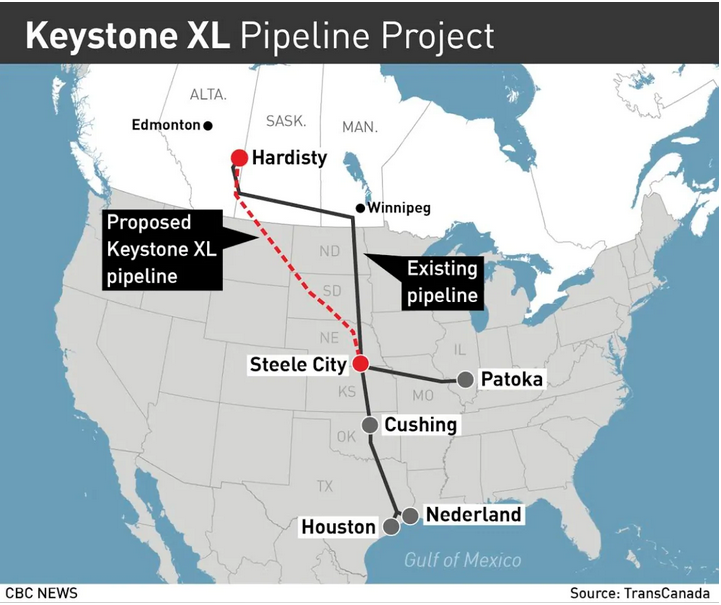

Oil production from these deposits differs significantly from the traditional methods we know. There are no wells here… these are basically open-pit mines. The bituminous sands obtained in this way, in order to obtain from them light liquid oil that can be transported by pipelines, require a number of technological processes that can adversely affect the environment. Therefore, the Keystone XL pipeline project to transport oil through the USA to the Gulf of Mexico and further into the world by sea met with strong opposition from environmentalists and has not had a chance to emerge to this day.

Today, however, a decision was made to start construction of this extremely necessary means of oil transport. Today TC Energy sanctioned the infamous Keystone XL pipeline with the support of the Alberta government. Construction will begin immediately, and when it is ready for use in 2023, it will be able to transfer 830,000 barrels of oil to the coast of the Gulf of Mexico, which will drastically improve the economic situation in Canada. Around the same time, a pipeline to the Pacific coast is also to be put into operation.

Undoubtedly, these are very good news for the Canadian oil industry and, consequently, the national currency, the Canadian CAD dollar.

The second factor that can support CAD in the short term is the huge wage subsidy that the Canadian government announced yesterday. Details have not yet been disclosed, but it is already clear that any company with a 30% drop in revenue can get 75% of the government’s first $58,700 in salary – or $1179 per week per employee. This will last for three months. This means that Canadian workers will receive support almost as much a week as Americans will receive a one-off for a coronavirus pandemic. Can they…? Yes they can!

From Monday to Friday – Live trading at 13:00 (London time) chat, analyse and trade with me: https://www.xm.com/live-player/basic

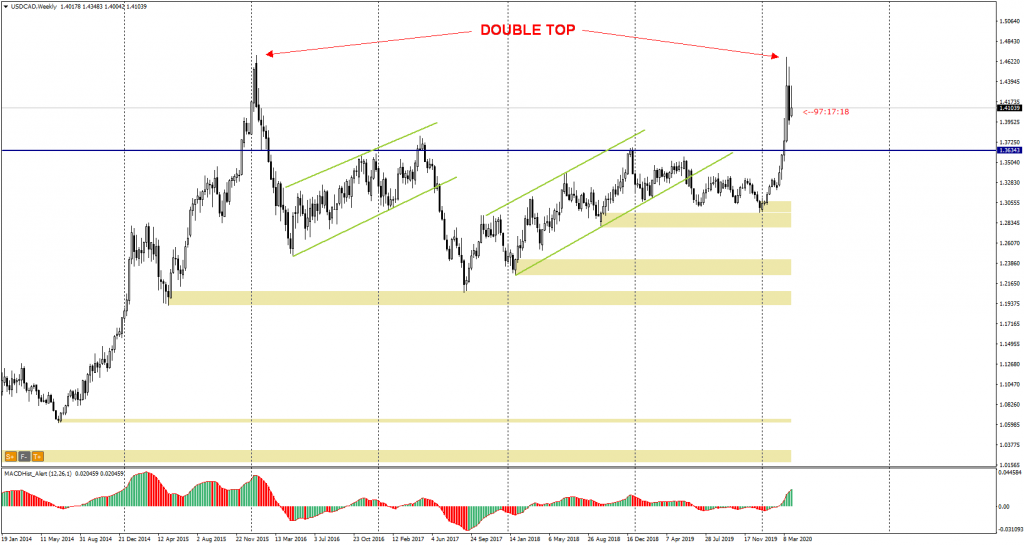

Based on this fundamental good news, I took a technical look at the USDCAD chart to see if the technical analysis will confirm the possibility of strengthening the Canadian dollar to the US dollar.

Looking at the weekly chart, we’ll see double-top formation under construction. If it were to happen, there would be big declines coming.

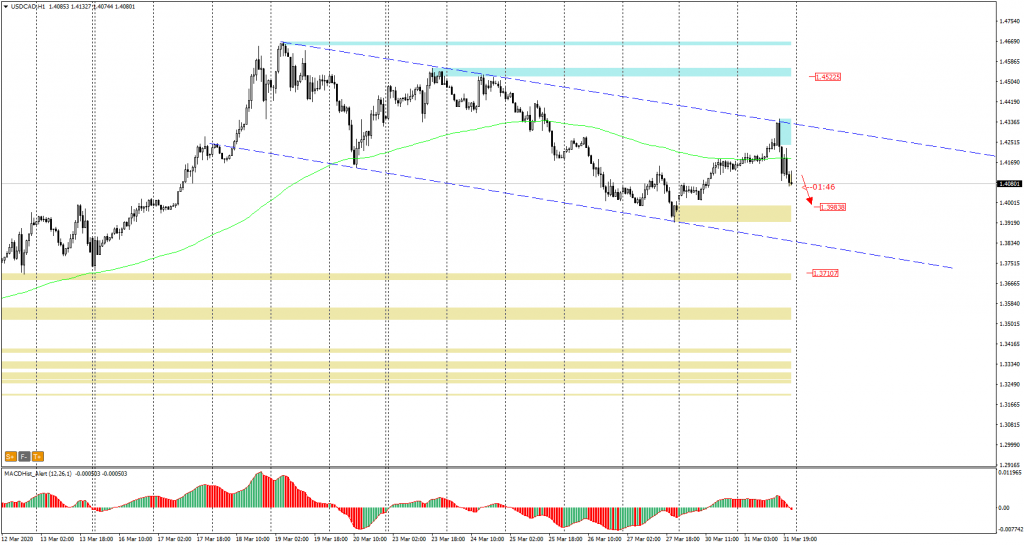

In the H1 chart, we see that the price is moving in the downward channel, and the supply goal may be the support of the channel. It is difficult to forecast in the currently highly volatile markets if the support will be overtaken and the demand zone is at 1.3980, but the good fundamental news may support this downward movement.

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities