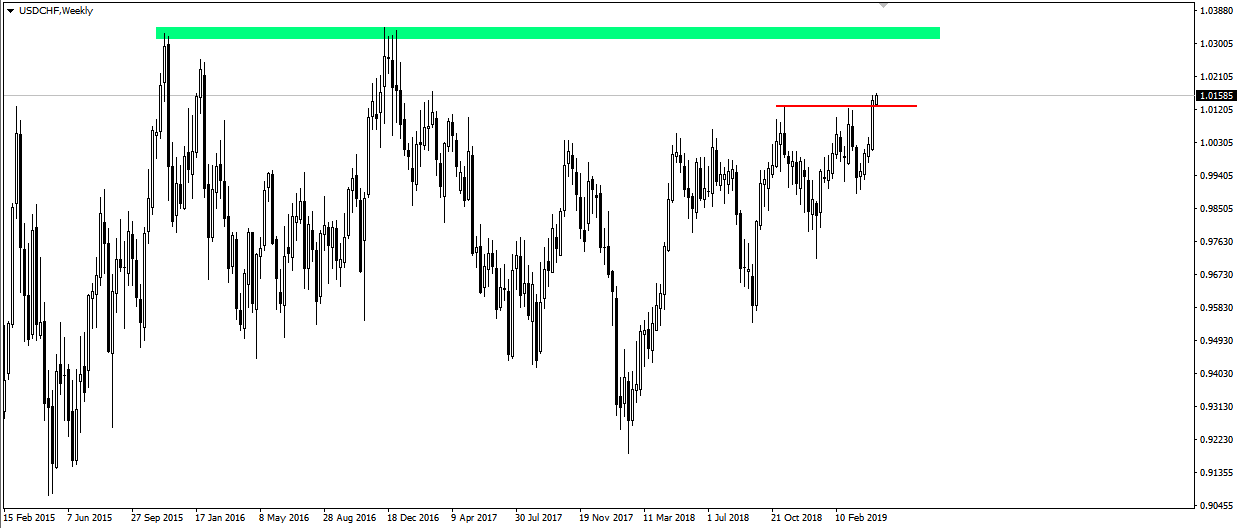

The USD/CHF quotations tested and even violated the maximum levels from November last year and March this year last week. Looking at the weekly chart, we can see that approximately in this region we have a supply zone, i.e. a region with several important highs. Starting from the second half of last year, the course bounced down in this area several times, but what is worth emphasizing, each time the bounces were getting weaker and weaker. It seems, therefore, that it is still the demand that distributes the cards in this system. If this continues, and the exchange rate breaks out around 1.0130, then in the long run demand may have an open path even to another resistance above 1.03, i.e. to the high of 2015 and 2016. Looking at the magnitude of the recent growth impulses, it seems that such a goal would be feasible to achieve. Join us in our Price Action Patterns group for serious traders, get fresh analyses and educational stuff here: https://www.facebook.com/groups/328412937935363/

Join us in our Price Action Patterns group for serious traders, get fresh analyses and educational stuff here: https://www.facebook.com/groups/328412937935363/