At the end of last week, after the Democrats gained an advantage in the US Senate, the US dollar gained to most currencies. Could this be a signal of the upcoming growth correction after 9 months of declines ? Of course it is best to follow the trend when trading forex, but we shouldn’t disregard the recent events in the US that could affect the future of the USD.

- Senate in the hands of Democrats

- New stimulation package on the horizon?

- Bullish pin bar on the dollar index

The consequences of the seizure of power in the Senate by democrats are easy to predict. On Thursday, Joe Biden will present his proposal for additional “trillions” in the stimulus program… and herald new taxes for the “wealthy”?

If anything like this passes through Congress in addition to the $900B already distributed, it could mean two years of economic growth. This week, Goldman Sachs has increased its forecast for 2021 to +6.4%, and the large stimulus package could also boost results in 2022.

On th e weekly chart of the DXY dollar index, a bullish pinbar appeared, suggesting further dollar appreciation.

e weekly chart of the DXY dollar index, a bullish pinbar appeared, suggesting further dollar appreciation.

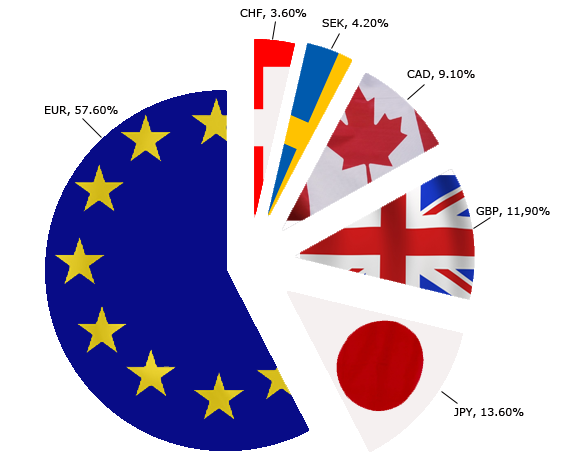

If the DXY index were to continue to gain in value – its largest component the Euro, representing 57.6% of the index should start to lose to the USD.

Let’s take a closer look at the EURUSD pair.

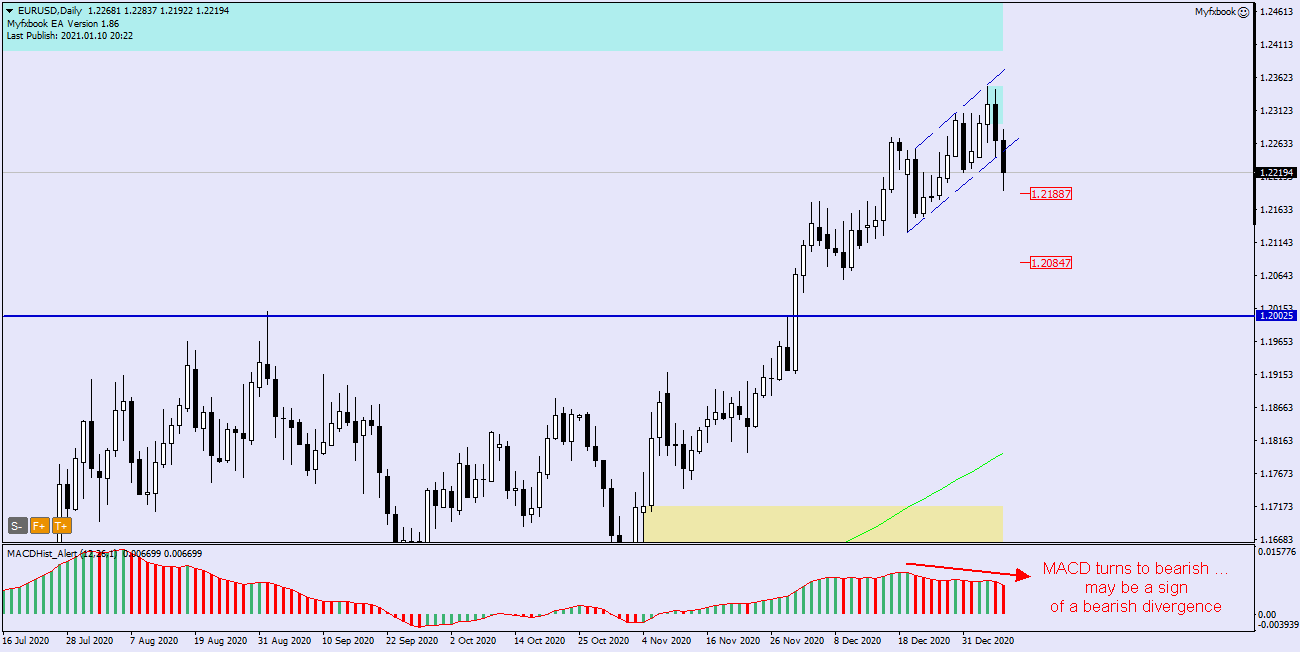

The EURUSD pair’s 2020 quotation gained nearly 9% to USD, reaching 1.2310 at the end of the year. In the first week of this year the quotation reached 1.2350, but the last two sessions turned out to be bearish.

On the daily chart, the price left the upward channel that had been going on for a month and a downward divergence appeared on the MACD oscillator.

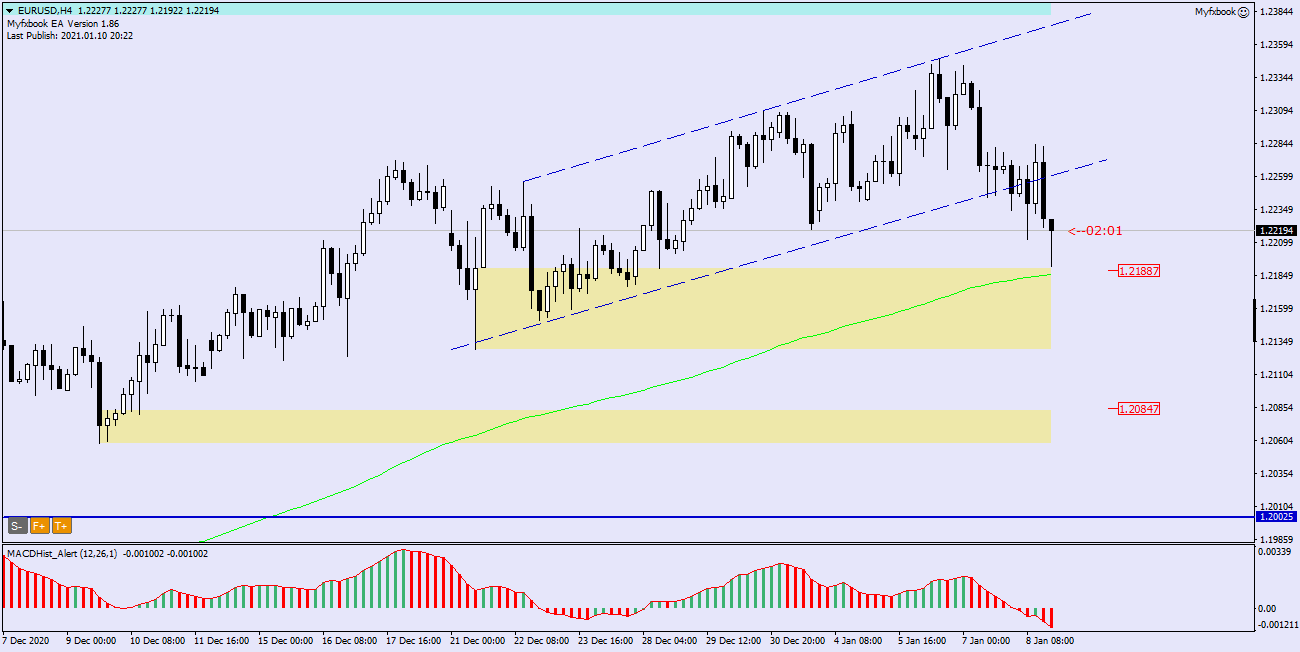

In the four-hour chart H4 we see that after the quotations reached the demand zone and the EMA144 average, buyers entered and the price went up.

It seems that a good place to open a sell position would be a retest of the defeated support of the channel, currently at 1.2250-60. The downward scenario will be negated when the price overcomes the last local maximum of 1.2290 and MACD returns to growth.

I recommend it:

Year 2020 – wins, losers and surprises. Part I

The year 2020 – winners, losers and surprises. Part II

ongoing analysis https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo