It has been a long and difficult year with many turbulences and changing conditions on the way. But here we are at the end, the last historic day of 2020 appeared in the calendar. Yes, historic – I do not hesitate to call the passing year that way. In the first part of the 2020 summary, I pointed out the leaders among the currencies and commodities that I think have gained the most to the dollar and other majorities. In the second part, we will look at the losers and the red lights of the currency market.

It has been a long and difficult year with many turbulences and changing conditions on the way. But here we are at the end, the last historic day of 2020 appeared in the calendar. Yes, historic – I do not hesitate to call the passing year that way. In the first part of the 2020 summary, I pointed out the leaders among the currencies and commodities that I think have gained the most to the dollar and other majorities. In the second part, we will look at the losers and the red lights of the currency market.

- The US dollar on an even slope, the pound carried by the post-brexit trade agreement

- Swedish krona’s exchange rate the winner among the G10

US dollar (USD) exchange rate as the leader of losers

Without hesitation, we can point to the USD as the biggest loser in 2020.

It was a wicked year for the American currency… It can be said that the ‘Greenback turned from a beautiful swan into an ugly duckling… unlike in the popular H.C.Andersen fairy tale…

The FED has undoubtedly made the greatest contribution to this transition. In August, J Powell announced the new monetary policy framework, announcing that he would allow his 2% inflation target to be exceeded, after decades of strict control.

Powell also said that he would no longer preventively raise interest rates to counteract expected inflation, which has been a standard Fed policy since the 1950s. Under the new policy, the Fed will not react until it actually sees rising inflation.

This is a clear message to the market – do not expect interest rates to rise in the coming years. You could say that we live in a ‘new age economy’ – good old economic laws, they are becoming less and less relevant. Nowadays, investors are less likely to ask themselves the question of what state the economy is in, and more likely to focus on tracking who cares about the economy better.

A weak dollar is good for exporters, and it also makes imported goods more expensive, making local products more competitively priced. This usually stimulates the economy. The problem on the horizon is inflation. It has already begun to appear in the prices of raw materials, such as iron ore, soya and maize. In the end, all this will hit the consumer, which may slow down the market and lead to stagnation.

The printing of money, or in fact its digital creation, in almost unlimited quantities has done its job . The dollar has become an unwanted ugly duckling. The appetite for more risky assets, giving a higher rate of return – such as shares of popular companies has grown.

A look at the dollar index chart shows unequivocally that the past year was a southward movement on an even slope. The loss of USD to the basket of currencies in the past year was 6.7%.

Exchange rate of the pound (GBP) also a loser

The British pound is certainly one of the currencies that cannot consider the past year as a success. The cov-19 pandemic exacerbated the UK’s economic problems, and the Brexit Saga, which has been going on for several months, could only make GBP weaker than other major currencies.

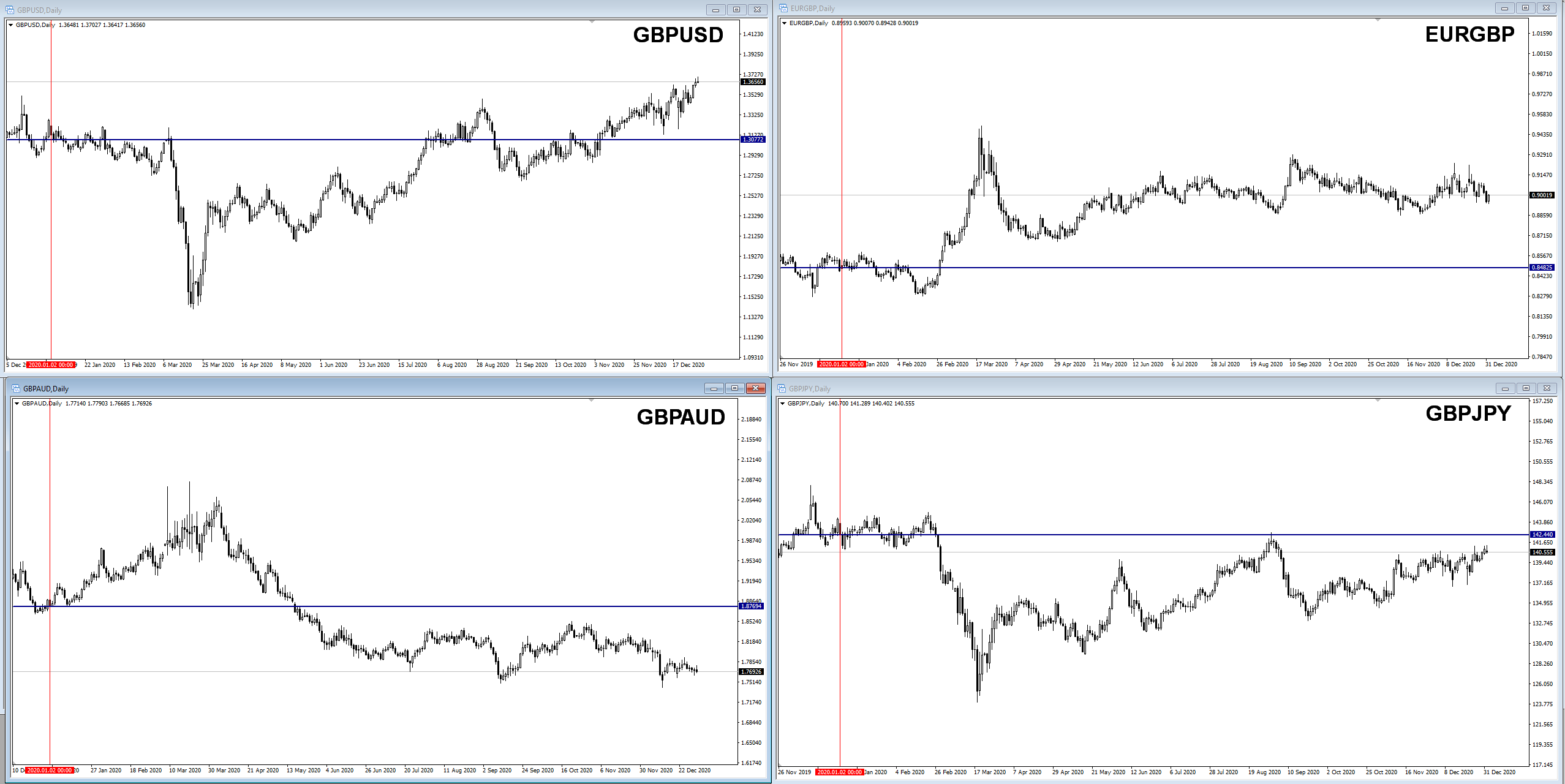

As can be seen in the charts attached, the British pound lost 6.5% to the Swiss franc, nearly 6% to the euro and AUD, and a little less to the Japanese yen – 1.5%.

The only currency to which the pound has gained in the past year is the US dollar, but this is due to the general weakness of the USD against all majorities. The worst times for the pound are early March and the ‘viral’ crisis.

Within 10 days, the exchange rate fell from 1.32 to 1.14, which proved to be the minimum of all time for this currency pair. Then it was only better. The exchange rate returned in August to the state from before the March drops and slowly climbed up.

At the end of the year, the media reports about the imminent signing of a free trade agreement with the EU made pound reach 1.3630, gaining 4% to USD y/y .

The question is how long will there be enough optimism from avoiding hard Brexit… Recent reports of the development of the pandemic in the UK are not promising. The sudden increase in the daily incidence of 56 000 on the last day of 2020 and the introduction of a strict lockdown in Scotland could be the announcement of another wave of the viral crisis.

In the next few days, we will probably see whether the recent increases will defend themselves or whether the harsh reality of post-brexit and covid -19 will direct the pound southwards.

The Turkish lira and the Brazilian real are the losers in the emerging currencies.

Among the currencies that suffered in 2020, but which are considered more exotic, I would mention the Turkish lira (TRY), the Brazilian real (BRL).

The Turkish lira, dealing with a central bank dependent on the government and political instability, was already losing 44% to the USD in early November. The reduction in foreign exchange reserves did not help, and the nail in the coffin was the flight of foreign capital from Turkish bonds and shares. At the end of the year, the trend reversed a little, but the TRY still closed the year with a loss of 24% to the USD.

The Brazilian currency BRL lost over 20% to greenback this year. The main problem of the Brazilian economy is low productivity and the slow pace of structural reforms. In addition, Brazil has been struggling with inefficiencies in its sanitary and healthcare services through its weak response to the viral crisis. Unemployment, which still amounted to 7 million in 2012, is not helping either; today, according to President Bolsonaro, it is estimated at 28 million.

The Swedish crown is the winner and the biggest surprise of 2020.

Yes, dear readers… It was the Swedish krona that distanced the other currencies most and gained up to 14% to the dollar in this difficult pandemic year. Sweden has taken a different approach to covid-19 from the very beginning, and the whole world has been watching closely to see how the lack of a strict lockdown and very little restriction will affect the health of its citizens.

Yes, dear readers… It was the Swedish krona that distanced the other currencies most and gained up to 14% to the dollar in this difficult pandemic year. Sweden has taken a different approach to covid-19 from the very beginning, and the whole world has been watching closely to see how the lack of a strict lockdown and very little restriction will affect the health of its citizens.

The economy has undoubtedly been well affected, the unnoticed rise in unemployment and the conservative policy of the Riksbank have made this currency the biggest positive surprise among the G10 currencies.

also recommend this :

Trading with PA+MACD, or how to increase the probability of winning

ongoing analysis https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo