Wide View Strategy (WiViSt) is a typical trend following strategy. Purpose of this strategy is enter in transaction at the end of correction which is identified in strong trend (uptrend or downtrend). There are two intervals used in this strategy: m30 and m15.

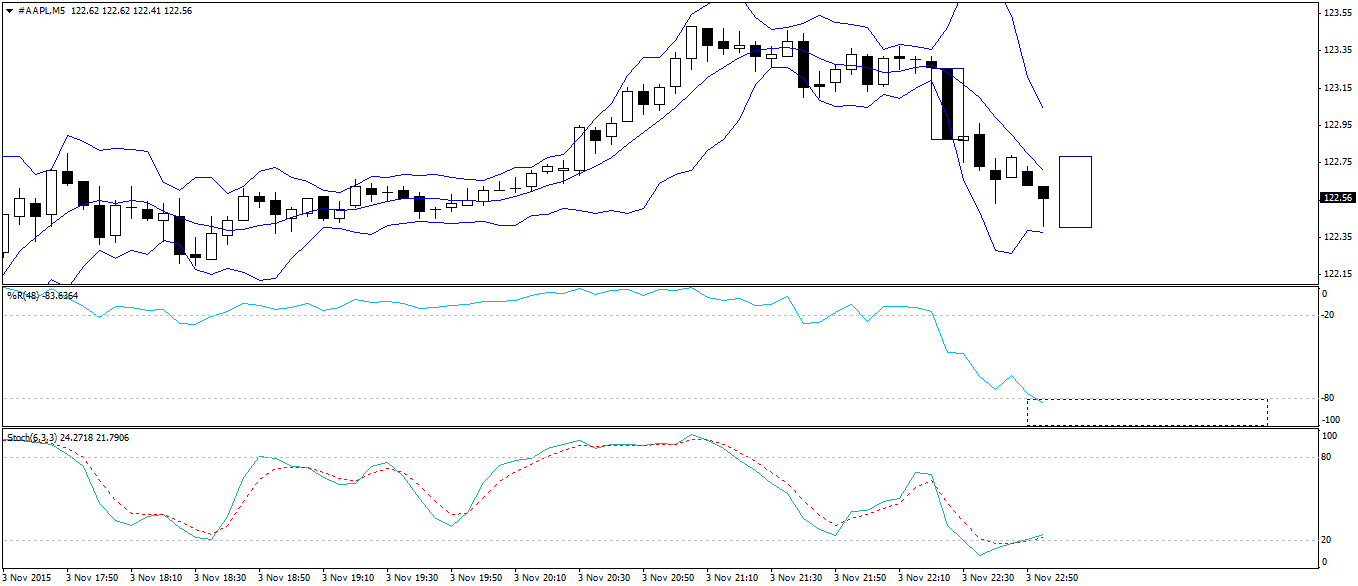

APPLE:

At the 30 minute chart we can observe that bulls are dominating. The nearest support is located at exponential moving average from the last 24h (122.53). Another support is at levels 121.56 and 121.00

On M5 chart we can observe that the %R is in undervalued area. Therefore we need confirmation in emergence of a demand candle.It is important that the body of the candle should be at least equal to the highest body of the counter candle in the last downward wave. Our candle body should be at least 39 cents.

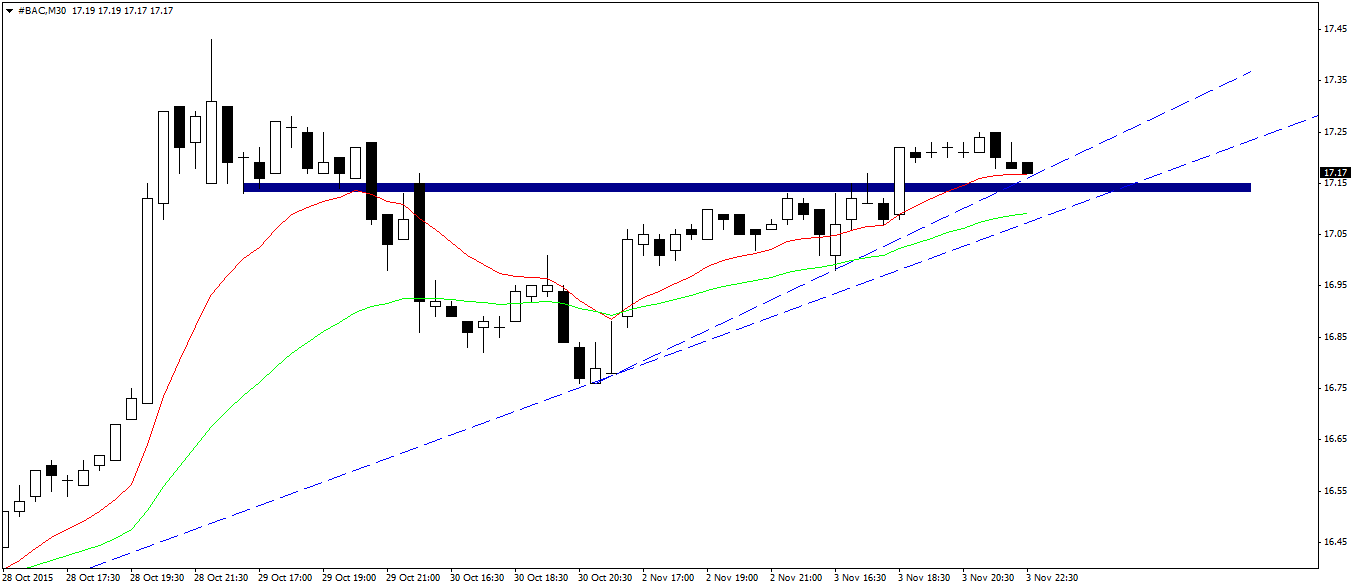

Bank Of America:

On M30 chart we can observe that yesterday’s close took place near important support level. At the same time, we see that the accelerated uptrend line is defending further price declines.

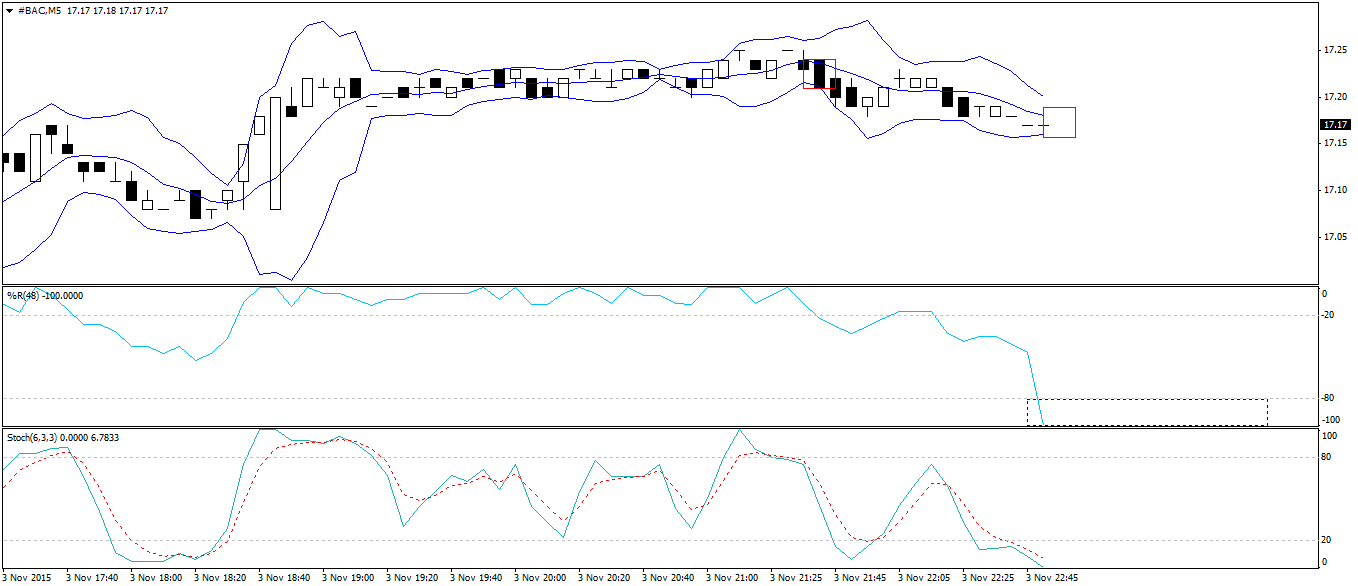

Considering the above, we go to m5 chart.

On this chart we can see clearly that Williams Percent Range is in the undervalued area. Therefore, we look forward to the emergence of candle signal, to take a long position. The candle should have body no less than 3 cents.