Yesterday (13.07) we had CPI (consumer price index), today PPI. After yesterday’s strong reading of US CPI inflation data, attention will once again turn to inflation, but this time there will be news from a different segment of the economy. Bond yields remain low and the US dollar is struggling to maintain Tuesday’s upward momentum, despite consumer prices reaching their highest level since 2008, a sign that markets are more convinced of the transitory nature of rising prices.

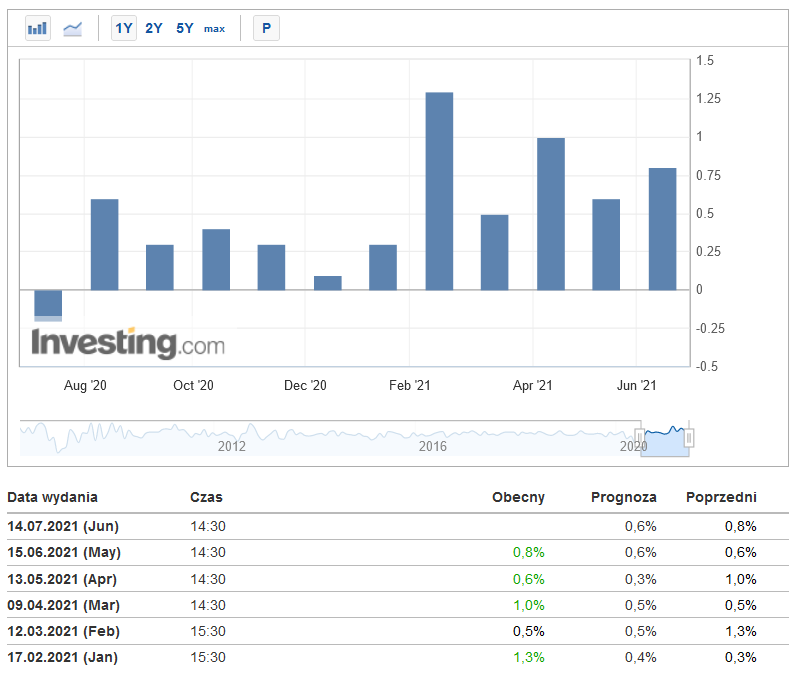

The key indicator here will be today’s PPI * – (Producer Price Index) data from the US, where we are likely to see the first signs of slowing inflationary pressures finally coming down. And we have already seen that producer prices in June came in lower than expected in both China and the UK, which is a positive sign that prices in the US may stabilise in the coming weeks.

Federal Reserve Chairman Jerome Powell is scheduled to testify on the economic outlook and recent monetary policy actions before the Joint Economic Committee in Washington. The testimony consists of two parts. The first is a prepared statement, followed by a question and answer session with the Commission. Part of the questions and answers in the testimony may concern the significant tendency of bond prices to move asymmetrically in relation to income.

I am confident that Jerome Powell will be closely watching the data coming in this afternoon, as he is due to address Congress at 6pm this evening, and a weaker than expected PPI reading would be excellent evidence for him that price pressures are transitory and that, once base effects are removed, the data only shows the natural course of the recovery. So no need to tapper?

How will the dollar react? If the data is no higher than the expected 0.6% (m/m) it will reduce expectations for monetary tightening and the USD may lose to the major world currencies.

By the way, I invite you to an hour-long live trading session Tomorrow, 14.07 at 13:00 GMT+1. Free admission, registration here: TRADING ROOM

*)The Producer Price Index (PPI) measures a change in input prices of raw, semi-finished or finished goods and services. If input costs rise, some will be absorbed by the producer and some passed on to the consumer. Conversely, if input costs fall, some of the decline will be enjoyed as wider profit margins by the producer and some will be passed on to the consumer in the form of lower prices. Because PPI impacts consumer prices, it is watched by central bankers as part of fulfilling their mandate of price stability. A reading that is stronger than forecast is generally supportive (bullish) for the USD, while a weaker than forecast reading is generally negative (bearish) for the USD.

I recommend description of the strategy used for this analysis:

ongoing analysis https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo