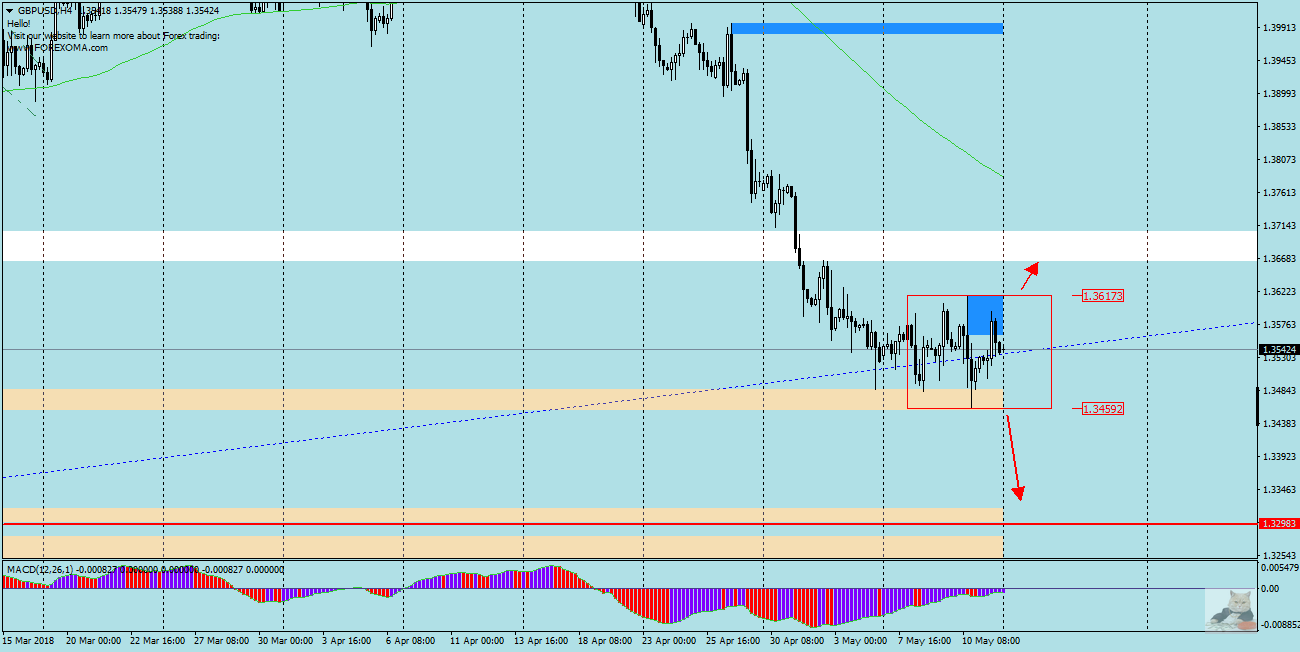

GBPUSD – has been in an upward trend for over 1.5 years. Maximum from 25.01 and 17.04 formed on the chart around 1.4380 a formation of (Double Top), which initiated the decreases. As a result of quite intense declines, the pair reached last week (04.05) the trend line extending from June 2017 low. Quotations from Thursday (10.05) breached this trend line, but the session closed above. Friday’s quotes did not go beyond the range of Thursday and an Inside Bar formation of 160 pips was created. The next sessions in case of breaking out of the consolidation created by Inside Bar should give an answer to the question in which direction the pair will move.

In the case of breaking thru the top from IB, the increases will encounter a resistance zone around 1.3665. This version supports the MACD oscillator, the value of which has been increasing since two sessions and in line with the PA + MACD strategy this may indicate the upcoming period of growth.

If, however, the bottoming of the IB should take place, the drops may be significant and move towards a strong support at 1.3300.