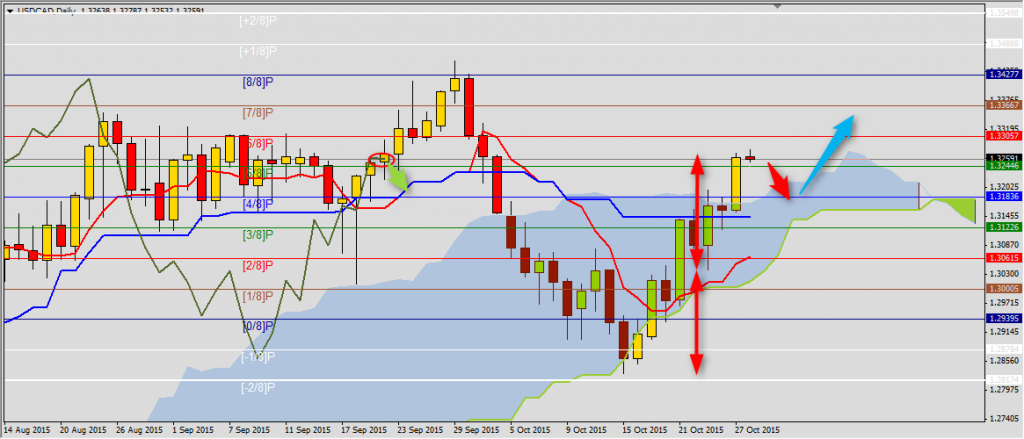

USDCAD

You can read Ichimoku strategy description here.

The minimal range for reversed H&S pattern on USDCAD was reached yesterday and buy order was closed in the end of day. In the closest sessions the most important for continuation of bullish trend will be defense of area 1.3182-1.3144 where is line (4/8)P, Kumo top and Kijun-sen. If USDCAD will stay above these levels next target will be (6/8)P 1.3306 and (7/8)P 1.3367. Decrease below Tenkan-sen 1.3064 will be a sign of coming back to bearish trend.

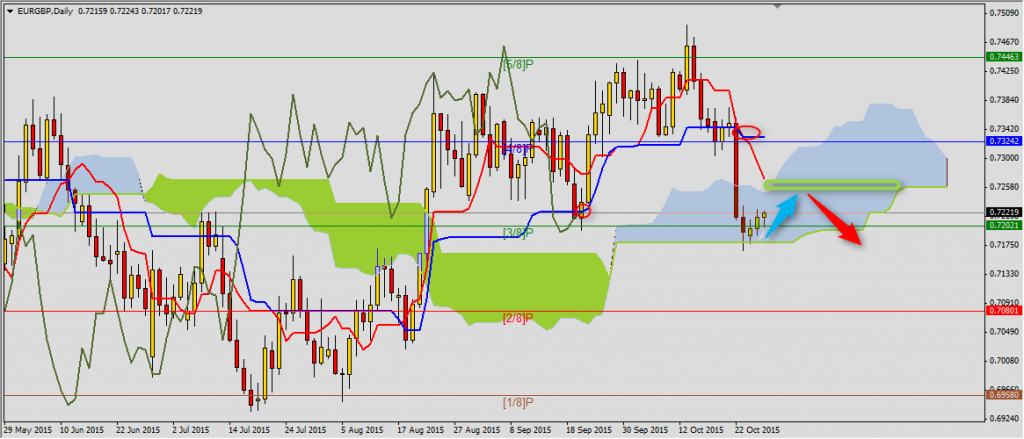

EURGBP

Decreases on EURGBP stopped next to lower band of Kumo 0.7178 and now possible is correction to area 0.7258-0.7270 where we have Senkou Span B and Tenkan-sen. In this area we should look for reversal trend signals and our range will be (2/8)P 0.7080.

YOU CAN TRADE USING ICHIMOKU STRATEGY WITH FREE FXGROW ACCOUNT.

NZDUSD

The pair is again below Tenkan-sen 0.6795 and price reached so far to support (7/8)P 0.6714. Breaking this level will be a sign of correction of bullish trend to 0.6592-0.6566 area, where (6/8)P and Kijun-sen are located. Breaking Tenkan-sen resistance doesn’t mean going back to bullish trend. Resistance (8/8)P 0.6836 and Kijun-sen from weekly chart 0.6849 are important. Only breaking this area will be a signal of gains to Senkou Span B on higher time frame, which is 0.7049.