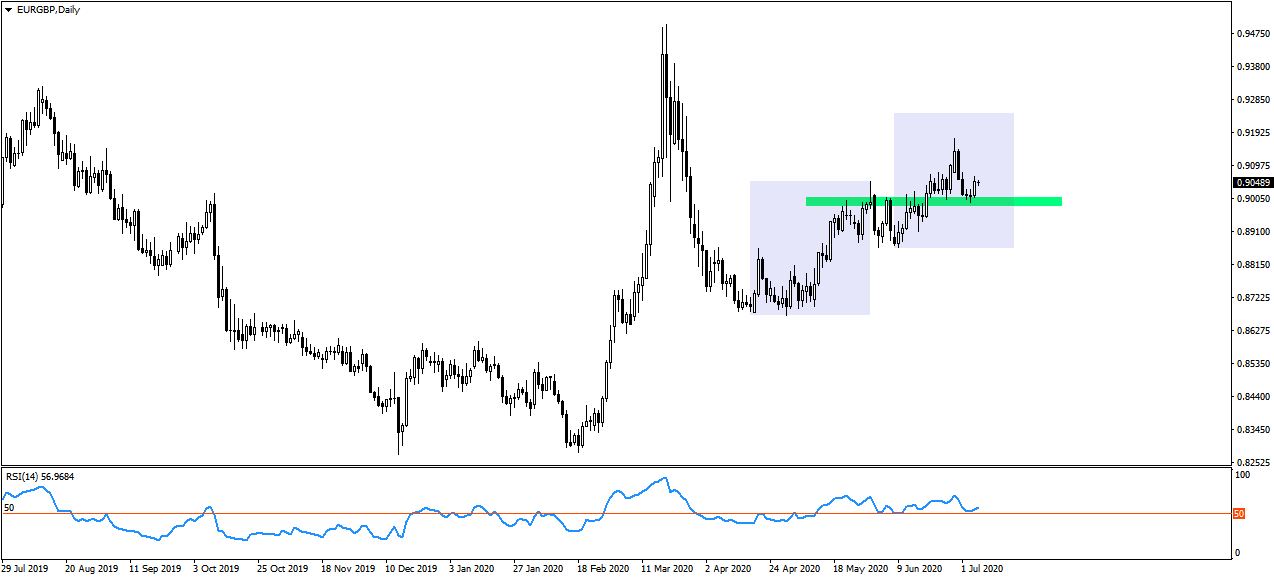

The EUR/GBP exchange rate reflects from a clear support. The RSI indicator confirms the upward trend.

The EUR/GBP pair has been corrected quite substantially and dynamically last week. However, the daily chart still clearly shows an upward trend. Yesterday, the first demand response after the correction appeared. It is noteworthy that the price rebounded slightly on a clear support zone, marked by a series of earlier peaks. It is therefore possible that we are dealing with a classic re-test, i.e. a return to the zone after the break-out. The potential range for an upward impulse is the range of the previous impulse, i.e. region 0.9240.

The RSI indicator has been working quite well in this area recently, with reversals up to 50% indicating quite good buying or selling opportunities. As for the fundamentals, the correction does not change the fact that the pound quotations are likely to be driven by concerns about further rounds of negotiations with the EU on a new trade agreement.

EUR/GBP reflects on support

In turn the euro may be influenced by the hope that European leaders will agree to an economic recovery fund by mid-July. So far against there have only been four countries, that are not the biggest, so this is resistance that can be overcome with some concessions.

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities