The direction of further movement of the quotations will depend on the result of the resistance test.

The pound rate is moving in a downward trend, as evidenced by the bottoms and heights forming at ever lower levels. However, the last peak was close to the previous one, which is a kind of warning sign. Another sign is today’s return to resistance. How can the GBP/JPY exchange rate continue to move?

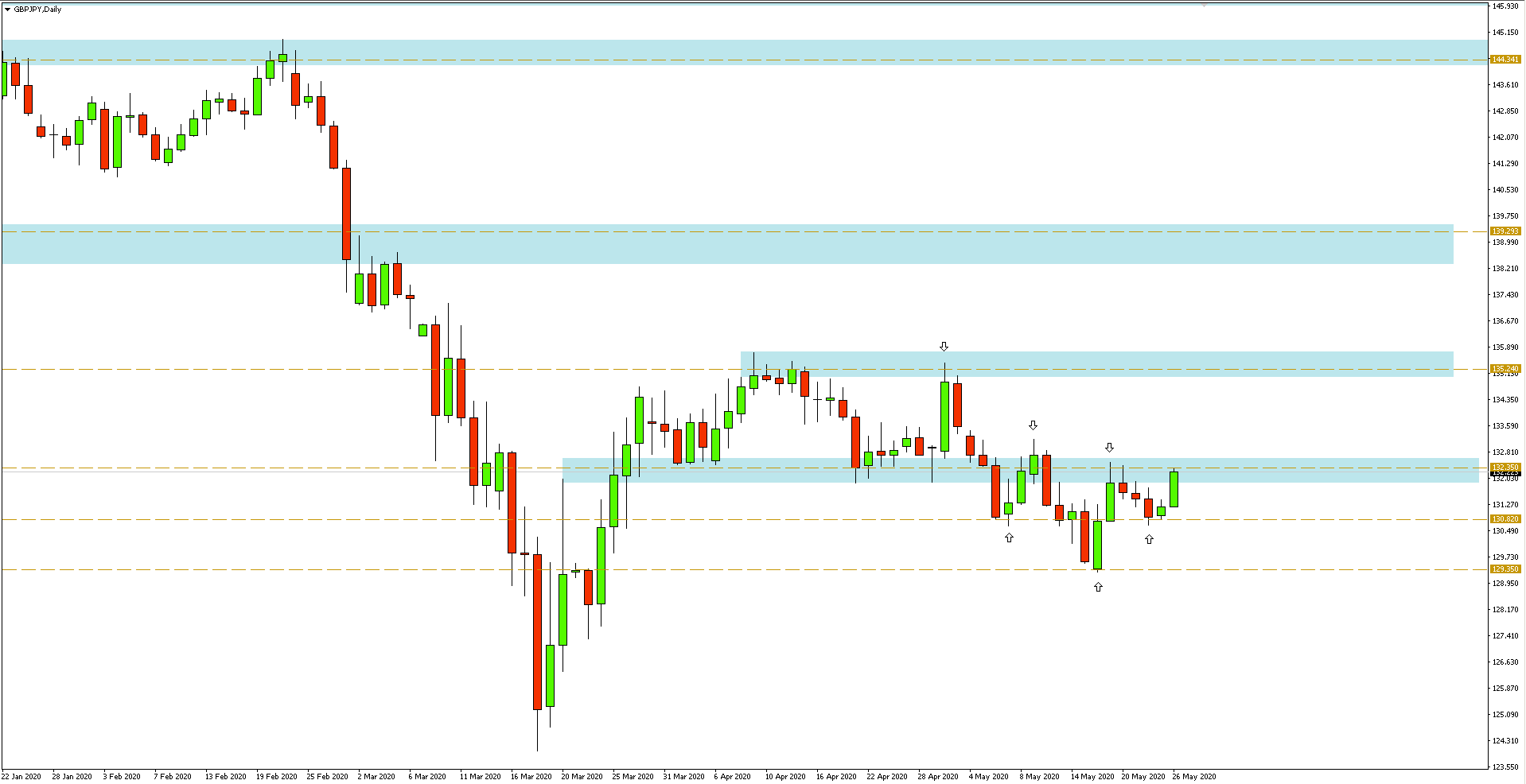

The pound to the yen is testing resistance at 132.35 for the third time this month

An effective upward break would open the way for growth in the direction of 135.24

The nearest support for GBP/JPY is nearly 130.82

As can be seen in the daily chart of the GBP/JPY currency pair below, the appreciation of the pound against the yen has today led back to a key resistance of 132.50. This area has also previously proven to be a support area.

The outcome of this resistance test will therefore be important. If it turns out to be positive, the closest local support to which they will be able to turn their quotations will be at 130.82, and another at 129.35.

Alternatively, breaking up above the resistance at 132.35 would give a chance for upward movement to the next defence zone near 135.24. There, one could then look for sell signals.

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities