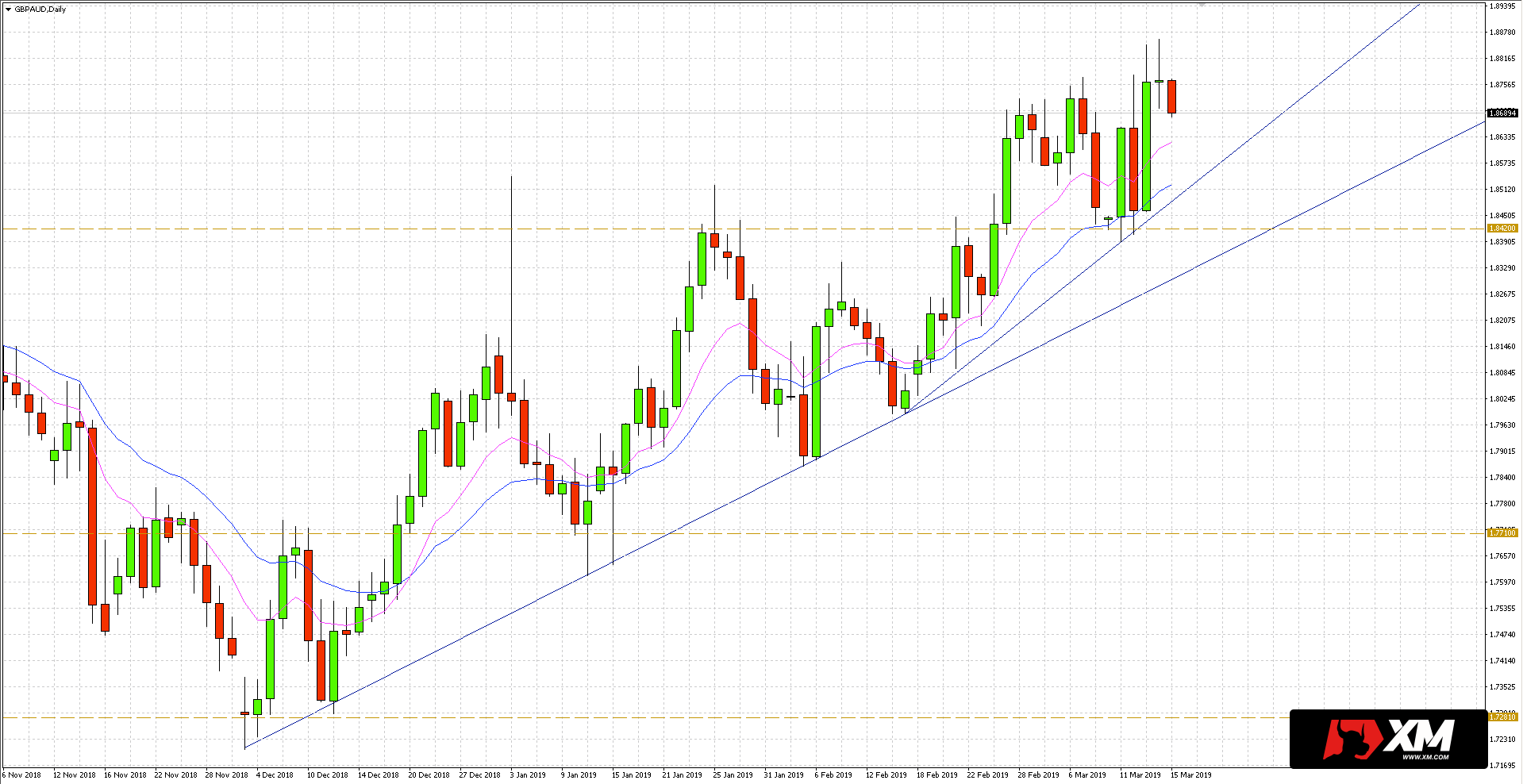

During yesterday’s session, the GBP/AUD rate set a new high at the levels recently seen after the announcement of the results of the Brexit referendum (June 2016). However, from the opening to the closing of the session, the price has not changed significantly, and a candle with long shadows on both sides of the body has been formed in the daily chart.

Currently, the pound is weakening to the Australian dollar. If this situation persists, it is possible that we will witness a support confluence test, where the accelerated upward trend line coincides with the average EMA 10/20 channel. It is from these areas that the price should return to increases, if their dynamics is maintained.

Alternatively, breaking the accelerated trend line would open the way to support 1.8420 or a trend line running from the December 2018 minima. No macro-economic readings for the pound or AUD are scheduled for today’s session. However, traders should still take into account potential Brexit news that may affect the volatility of the GBP.