The FOMC meeting and the Fed members’ vote on US interest rates indicated the possibility of an earlier monetary policy tightening than anticipated back in March this year.

- FOMC members accelerate possibility of interest rate hikes

- 16 official speeches by FED representatives this week

- BoE meeting will strengthen the British pound?

On the so-called ‘dot-plot’ list, those willing to raise rates faster have increased. The median is now two hikes in 2023 compared to no hike in March. There has been much talk of a shift towards a single hike, but two is the real surprise. Furthermore, 7 out of 18 members see a raise next year and that is now in play. ( details here:)

This week will be packed with statements from Fed members, we can expect at least 16 official speeches that could have a significant impact on USD sentiment.

Crosses safer this week?

For this reason, among others, I became interested in crosses, i.e. currency pairs that do not contain USD, which by their nature will be less vulnerable to market reactions against USD. EURGBP and GBPJPY are undoubtedly worth paying attention to this week. Why… just look at Thursday’s events on the economic calendar.

Super Thursday awaits us – that is the Bank of England meeting and monetary policy decisions in the UK. Here we will also see if the ratio of those voting for polmon tightening and raising % rates will change. At the last meeting it was 9:0. Any change will be a bullish signal for the pound.

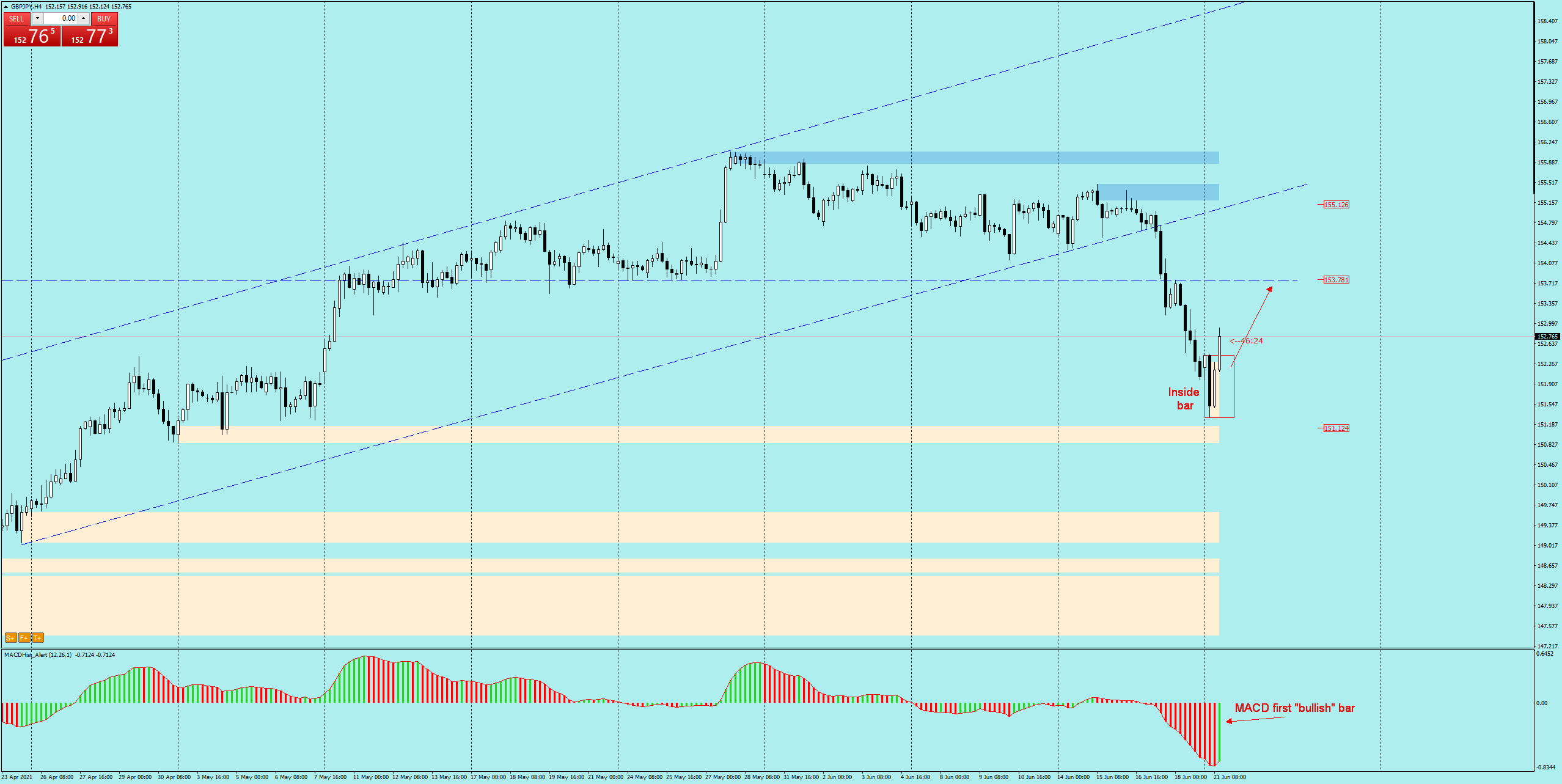

Analysing the GBPJPY pair purely from the technical side, we can see on the H4 chart signs of the end of the downward correction. An inside bar formation appeared and the price has already broken out of it. The price leaving the formation caused that on the MACD there was a minimum and the oscillator entered the phase of growth.

Any retracement of the price back towards the inside bar maximum can be an opportunity to open a buy position. The stop loss should be below the break-out candle. In case of an upward scenario the nearest target could be the support and resistance level at 153.75.

I recommend a description of the strategy used for this analysis:

FED decisions and what next? USDCAD in an upward correction.

ongoing analysis https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo