Following the recent Fed decisions (22.09) and the rise in expectations of monetary tightening in the US, the US dollar has strengthened significantly against most world currencies and gold.

- Gold may recover some loses

- Yen begins correction

Today we can see that there are signals of the beginning of corrections on Gold and on the pair USDJPY. Analysis based on PA+MACD strategy.

GOLD

Gold lost quite a lot after Wednesday’s FED meeting and only today the first signs of growth correction appeared. The increases may be limited by the support of the flag from which the price broke down yesterday. Currently, the price is leaving the inside bar and on the MACD there is an upward divergence supporting the growths.

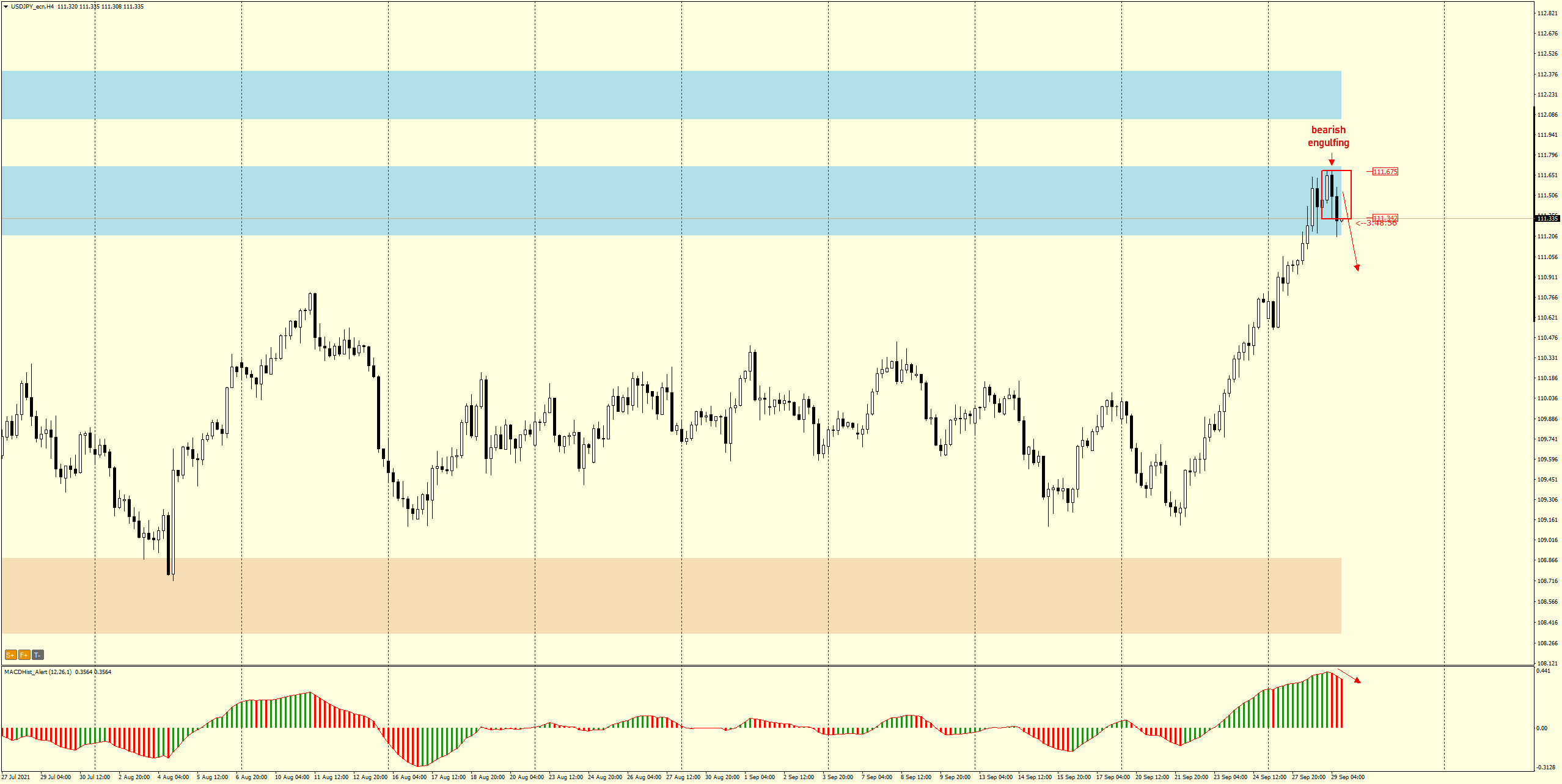

USDJPY

The pair has gained significantly over the past few days, since last Wednesday the pair has gained over 250p. Today, on the H4 chart, a bearish engulfing pattern appeared and the price is already breaking out to the downside. The MACD oscillator clearly shows a downward trend, which increases the probability of falls. The supply target may be the demand zone located at 110.60.

Today, Wednesday, September 29 at 13:00 I will have live trading session in basic room. I will explain the above trading ideas.

I recommend a description of the strategy used for this analysis:

ongoing analysis https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo

In our Facebook group, which you can join anytime: https://www.facebook.com/groups/328412937935363/ you will find 5 simple strategies on which my trading is based. There, every day we post fresh analyses of currency pairs and commodities. You can also visit my channel where I post my trading ideas: https://t.me/TradewithDargo

See other most frequently searched phrases today: cd quotations | ruble exchange rate forecasts for the next days | playway shares chart |