About 10:30 we got to know the results of the latest report from the British labor market. The most important figures were better than analysts’ projections. In this article we check how this translated into trading on pound sterling.

About 10:30 we got to know the results of the latest report from the British labor market. The most important figures were better than analysts’ projections. In this article we check how this translated into trading on pound sterling.

In her speech yesterday, the British prime minister Theresa May, who spoke about the plans for Brexit, argued that since the June referendum macroeconomic indicators are much better than economists assumed. The confirmation of her words, among others is the latest report from the local labor market:

- The unemployment rate (November) 4.8% according to the forecast and the result of the October

- Changing the number of people applying for benefits (December): -10,1 th., 5000 forecast, before 1300 (revised downward)

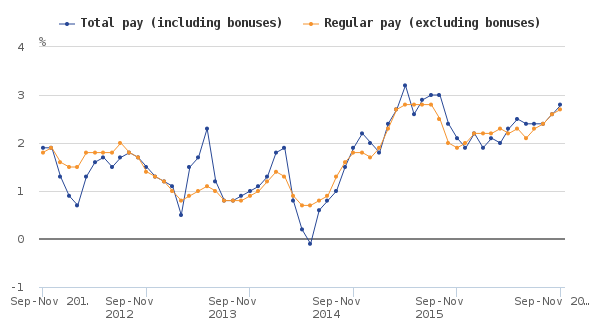

- Average wages excluding bonuses (November): 2.7% vs. 2.6% previously to 2.6%

- The average salary including bonuses (November): 2.8% vs. 2.6% previously to 2.6% (after a revised growth of 2.5%)

In addition to strong declines in applying for benefits positively looks dynamics of wages inflation which in turn resulted in a strengthening of the GBP. In terms of today’s whole session, GBP/USD loses – drop stopped around 1.23040, where we find highs from session of January 12:

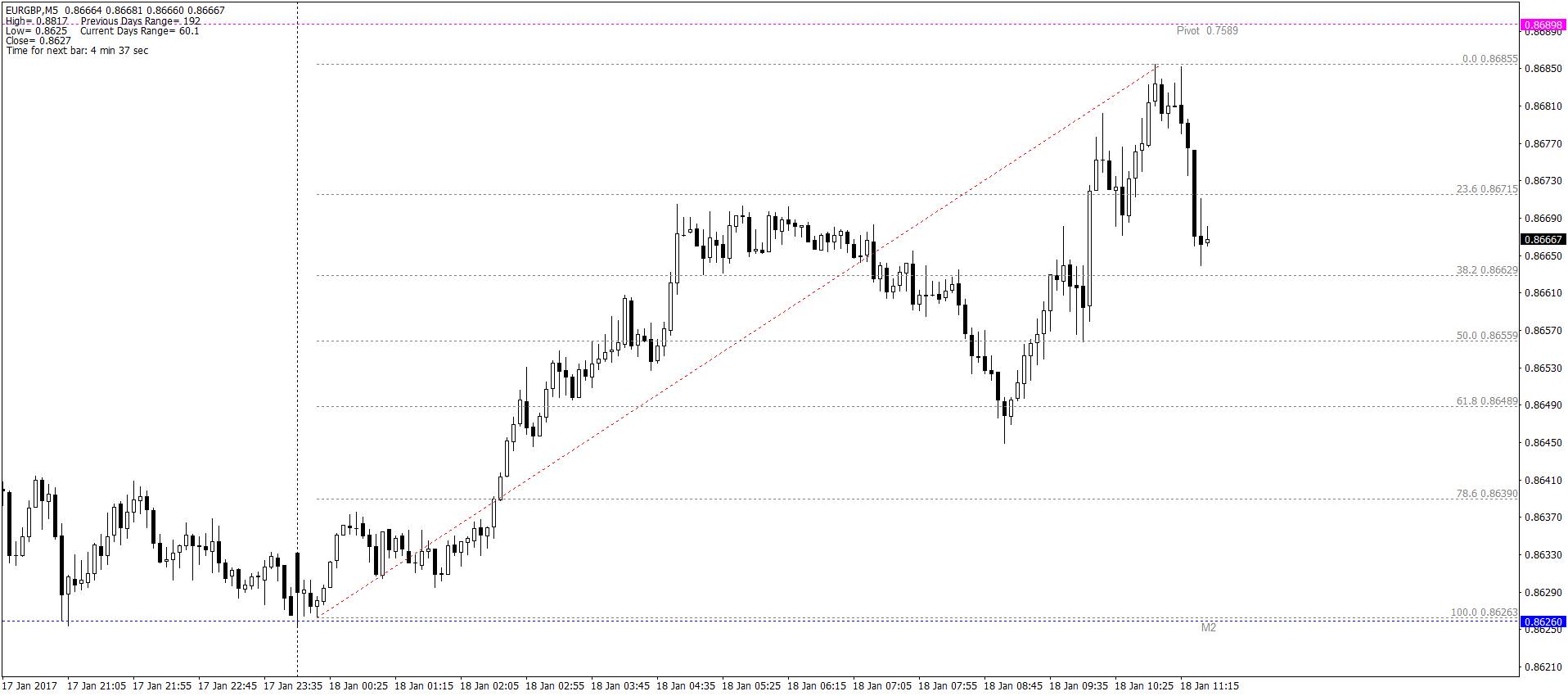

EUR/GBP also weakens pound, the appreciation stopped just under the daily Pivot and since then pair lost about 20 pips: