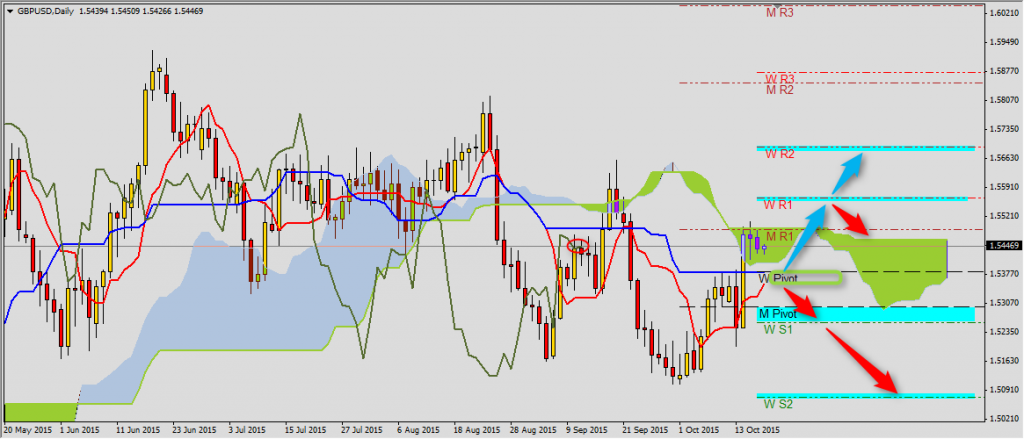

GBPUSD

You can read Ichimoku strategy description here.

For now GBPUSD still cannot break epper band of Kumo at monthly R1 1.5491, but Chikou Span stays above screen which gives us hope for continuation of gains. Kijun-sen 1.5383 is very important which covers weekly pivot. However there is sell signal on this pair so we should have pending order below Tenkan-sen 1.5354 for continuation of bearish trend. The range will be first 1.5296-1.5257 area created by monthly and weekly S1, and then S2 1.5073. If GBPUSD will stay above Ichimoku lines, then correction will lead price to weekly R1 1.5565 or even R2 1.5690.

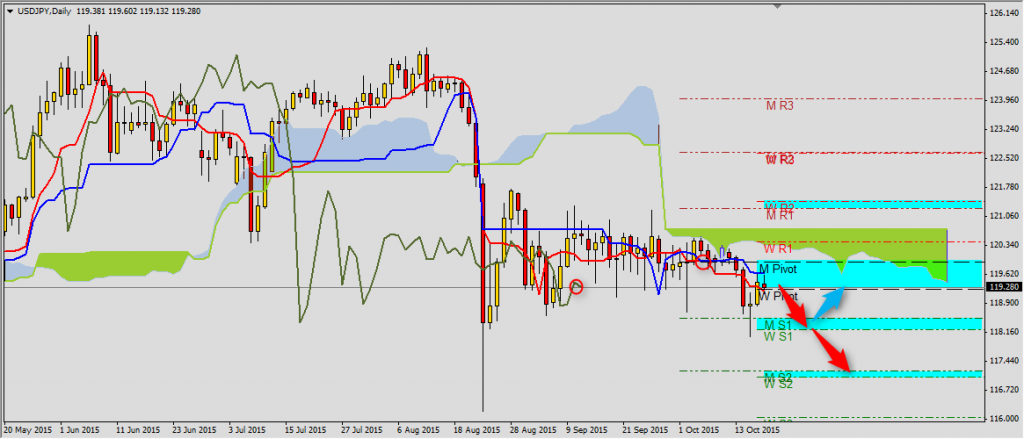

USDJPY

USDJPY started a week from testing Tenkan-sen and pivot 119.23. Kumo is bearish, Chikou Span is below chart and Tenkan-sen is below Kijun-sen. All signals inform us about probable generating of sell signal. First support area is 118.50-118.22 (monthly and weekly S1) and then 117.19-117.04 (monthly and weekly S2). Breaking USDJPY above monthly pivot 119.91 will mean going back to side trend with upper bans of channel 121.25-121.42 (monthly R1 and weekly R2).

YOU CAN TRADE USING ICHIMOKU STRATEGY WITH FREE FXGROW ACCOUNT.

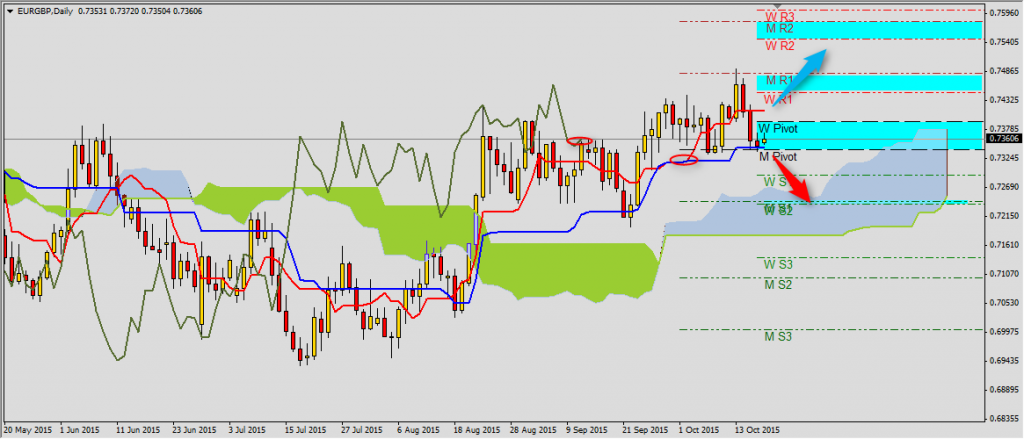

EURGBP

Bullish trend on EURGBP stayed above monthly R1 0.7483 and today price is above Kijun-sen support and weekly pivot 0.7344-0.7339. Chikou Span stays above chart, Kumo is bullish and another break above Tenkan-sen 0.7412 will generate buy signal. However first area of resistance is very close (0.7446-0.7483). Next resistance is set by weekly and monthly R2 0.7547-0.7580. Drop of the price below Kijun-sen will mean correction on EURGBP to level Senkou Span B and monthly S1 – weekly S2 0.7254-0.7237.