The Christmas period is over, the world of finances has returned to work, what we could see on the night of January 3/4, where “flash crash” on pairs with JPY, AUD and NZD caused a lot of confusion and jumps of 400 pips on correlated instruments. Last week also brought increased volatility on most pairs, and the daily movement ranges exceeded 100p.

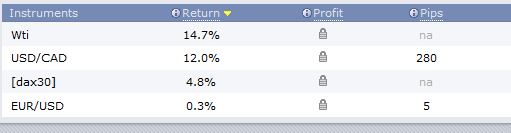

In today’s weekend summary I will return to the analysis from the 26th of December devoted to OIL.WTI. Then in “OIL.WTI – will oil rise from the knees?” I predicted growths based on the emerging Outside Bar formation and the rising divergence of quotations:

“The daily chart shows that today’s candle is the Outside Bar, the so-called bull market, which usually heralds a change in the trend or at least a correction. Additionally, an upward divergence on the MACD has started, which supports the signal for growths. Analyzing the H4 chart below, it seems possible that during the probable correction of the recent falls the price may return to the triangle from which the breakout took place on 17 December.”

It took some time, the Christmas period was not conducive to high volatility, we had to be patient and finally…. on Wednesday after 10 trading days, the “prophecy” came true, which can be seen in the chart below.

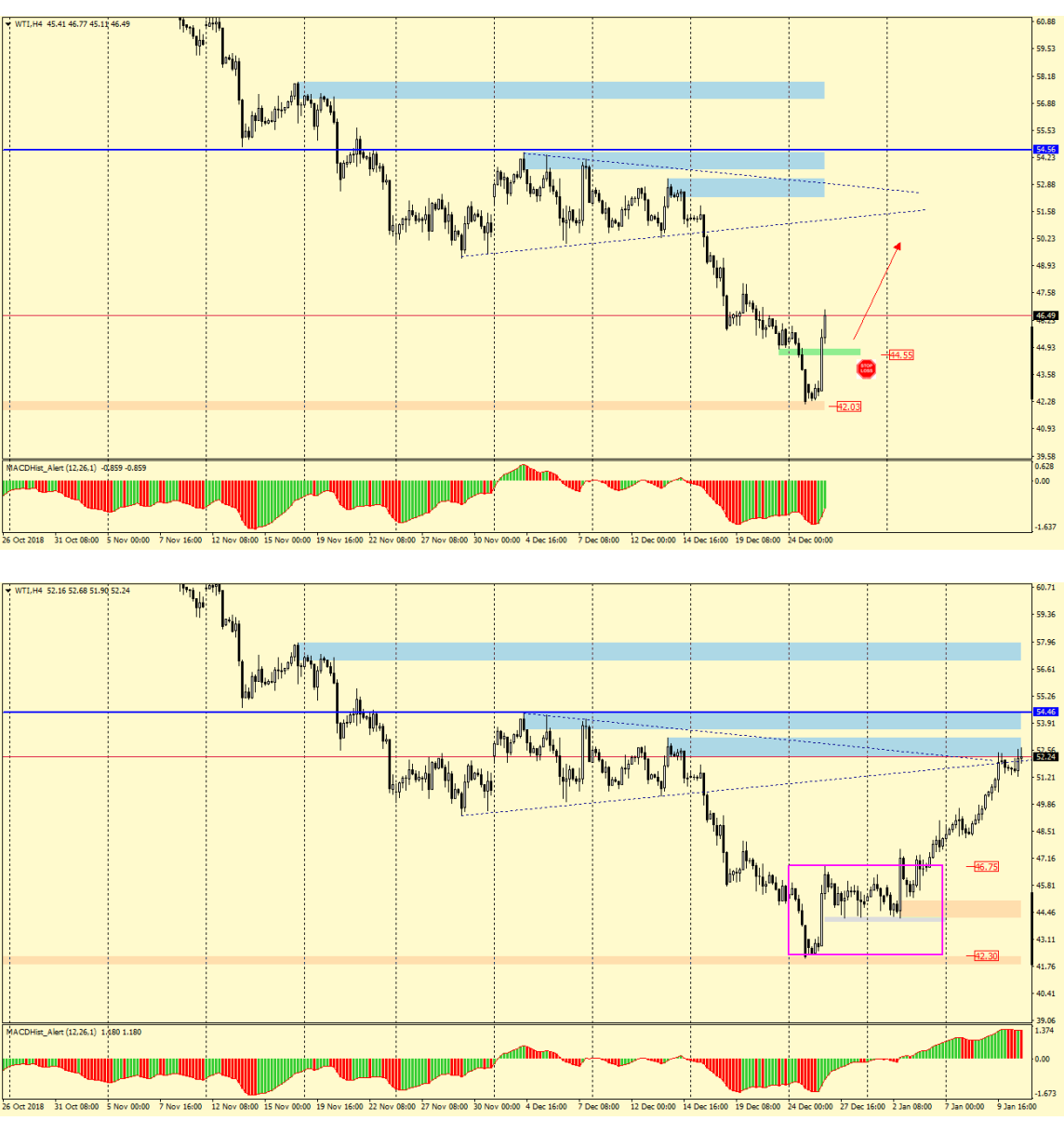

DAX30 – Price Action vs. Over Balance – who will be the winner?

Under this title, I posted an analysis on 7 January, in which I used two different strategies to determine the probable direction in which the DAX30 index will go.

The first strategy is Over Balance, which assuming the equality of corrections in the downward trend pointed to the upcoming falls, i.e. the south direction. The second one, based on candle formations and MACD oscillator – PA+MACD – indicated increases, i.e. north.

From among mutually exclusive directions – I decided to choose the north direction because the PA+MACD analysis seemed to me more probable. And how did the market behave… whose direction is right? We will probably have to wait until next week for the answer to this question because looking at the chart below we can say that so far there has been a draw. DAX was moving in both directions, both south and north, gaining or losing exactly the same number of points from the starting price. I still stand by the increases and I will not hesitate to comment in the next weekend’s summary which way the market has chosen.